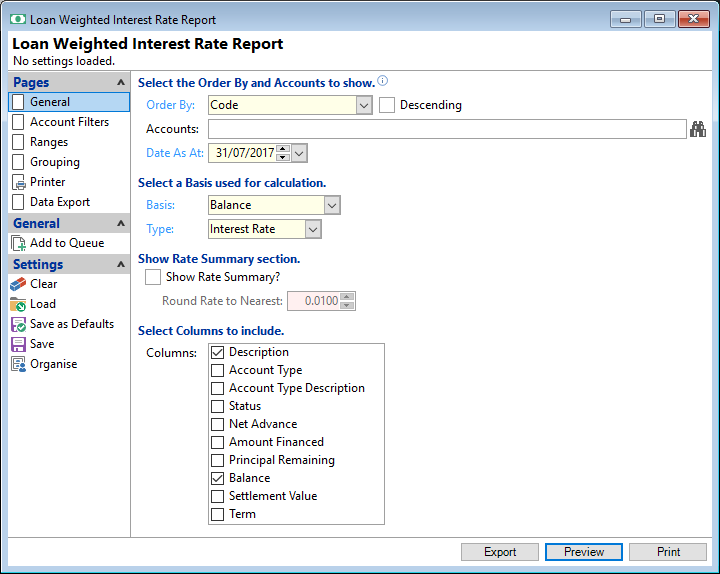

Report

| Description |

The Loan Weighted Interest rate Report displays the trend or Comparative values over time, for such things as current Balance, Amount Financed, Net Advance, Principal Remaining or the Settlement Value. |

| Purpose | An effective marketing tool which allows you to analyse weighted interest rates. |

Order By

Select the order in which the report is to appear, by Code, Name, Date Opened, Date Quoted, Overdue, Overdue Days, Contractual Overdue, Contractual Overdue Days, Balance, Next Payment Date, Last Payment Date or Maturity Date.

Descending

Tick to display in a descending order or leave blank to display in an ascending order.

Accounts

Select accounts to be included or leave blank for all accounts.

Date As At

Enter the report "As At" date. The Date 'As At' is used when calculating values such as Balance and Overdues.

Basis

Select from Balance, Amount Financed, Net Advance, Principal Remaining or Settlement Value.

Type

Select from Interest Rate, Flat Interest Rate and Comparison Rate. These options will only appear where they are being used on an Account Type.

Please click here for more information about "Comparison Rates".

Show Rate Summary

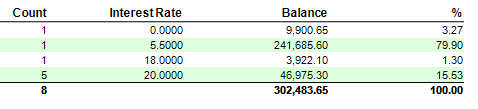

Tick to show a breakdown summary of rates at the bottom of the report. This will include the Interest Rate, how many accounts for each Interest Rate, the Basis (i.e. Balance) and percentage.

The "%" column shows the percentage of the total loans that are at each percent listed, e.g. 5 Loans @ 20.00% with a current Balance total of $46,975.30 is 15.53% of the total open loans.

By ticking "Show Rate Summary", the "Round Rate to Nearest" will need to be entered; it defaults to "0.0100".

Columns

Tick to include columns and corresponding information required for the report; leave blank to not include this information.