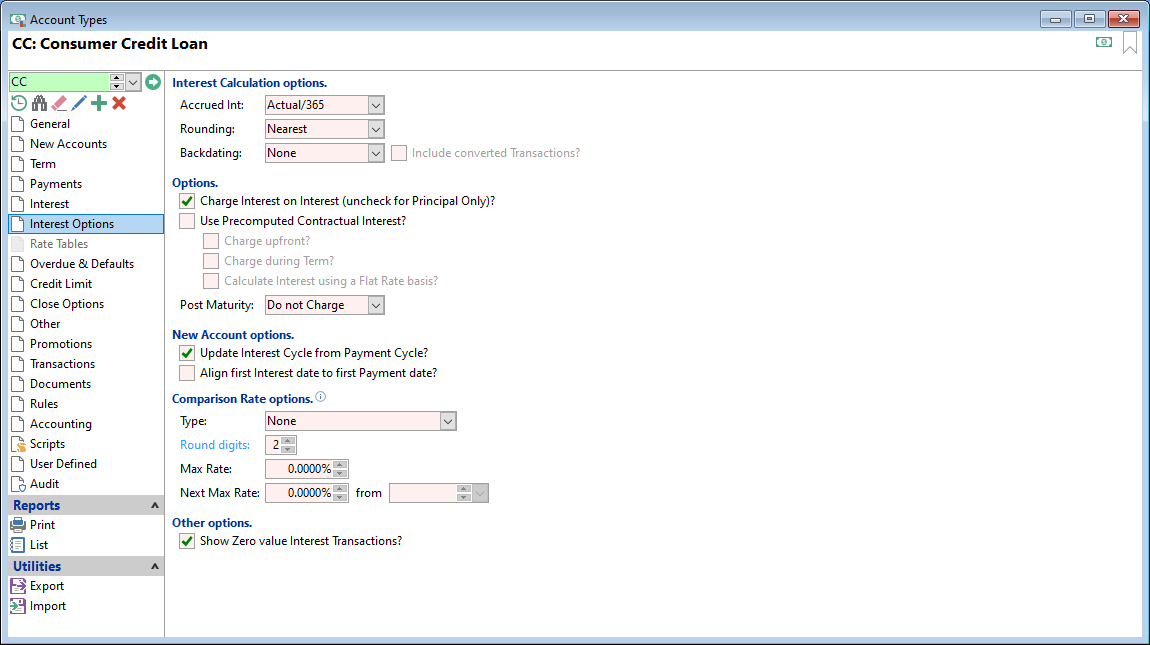

This page refers to the fields available on the Account Types, Interest Options page.

Below the image of the page, you will find itemised descriptions of the fields and a basic guide of what is required.

Accrued Int

Select from the dropdown list one of the following:

| Method | Description |

|---|---|

| Actual/Actual | Daily balance * Interest Rate / number of actual days within the Calendar year |

| Actual/360 | Daily balance * Interest Rate / 360 * number of days |

| Actual/365 | Daily balance * Interest Rate / 365 * number of days |

| Annualised |

Daily balance * Interest Rate / number of actual days within the Calendar year then divided by 12. For example, if charging a whole month's interest, instead of taking the total of each day's daily interest an annualised value is calculated and then divided by 12. This means the same interest will be charged irrespective of the month having 30 or 31 days. Interest Cycle - Quarterly: Interest is calculated slightly different to weekly/monthly. Example: Opening Date: 05/08/2010, Loan Advance: $1,500.00, Term: 12 months, Payments: Monthly, Interest Rate 17%, Interest Cycle: Quarterly. On the interest audit for the end of October, the first period of interest (5 August to 4 September) is calculated as follows: $1500 x 17%/12/31 x 27 =$18.5081 & $1500 x 17%/12/30 x 4 =$2.8333. Total interest is $21.3414 = $18.5081 + $2.8333. |

Rounding

Select from the dropdown list one of the following:

| Method | Description |

|---|---|

| Nearest | Select to round the Interest to the nearest currency value. |

| Down | Select to round the Interest down to the nearest currency value. |

| Up | Select to round the Interest up to the nearest currency value. |

Backdating

Select from the dropdown list one of the following:

| Option | Description |

|---|---|

| None | Interest and Fees will not be re-calculated if a transaction is backdated past the Interest Charged To date. |

| Tracking Only | Interest and Fees will not be recalculated, but the date of the backdated transaction will be recorded so that you can report on Accounts which have had backdated transactions in this interest period. The Backdated Transaction record will be removed the next time Interest is charged, so it is important to perform any actions required before processing interest again. |

| Reverse | Interest and Fees will be re-calculated if a transaction is backdated past the Interest Charged To date. |

Include converted Transactions?

Tick for transactions with an Element Type of "Interest" and a Source of "Converted" to also be reversed and re-charged where Interest and Fees are being reversed and re-charged when transactions are backdated.

Charge Interest on Interest (uncheck for Principal Only)?

Tick where interest is to be charged on any unpaid Interest. If the Account Type is for "Principal Only" loans, this option should be left unticked.

Use Precomputed Contractual Interest?

Tick this option to calculate the precomputed Contractual Interest and charge to the Account regardless of whether a payment is paid early or late.

Charge upfront?

Tick to add the total interest to the loan on Opening date, allowing interest charges to be treated like other upfront costs. This means the precomputed Contractual Interest is charged to the Account and does not vary if a payment is paid early or late, i.e. the Interest is fixed and charged when the Account is opened.

The Opening (original) Financial Schedule of the Account shows the Interest to be charged within each Interest Period providing a full breakdown of Interest calculations. The ongoing Financial Schedule of the Account will still show Interest charged at the end of each Interest period, however the Interest value is zero.

Charge during Term?

Tick this box to charge Interest to the Account based on the original (contractual) interest schedule, regardless of the Account's daily balance. This means that Interest will be charged according to the Opening Schedule, even if payments are made earlier or later than originally scheduled.

Calculate Interest using a Flat Rate basis

Tick to calculate and charge upfront Interest on the loan without taking into consideration that periodic payments reduce the amount loaned. For example, if an individual takes a $10,000 loan for 12 months at 10% using a flat interest rate, the interest charge would be calculated at $1,000.

Post Maturity

Select from the dropdown list one of the following:

| Method | Description |

|---|---|

| Charge | Select to continue to charge Interest and Default Interest once the Account reaches it's Maturity Date or a Payment Arrangement's Final Payment Date, whichever date is the latest. |

| Do not Charge | Select to SURPRESS all normal Interest charges once the Account reaches it's Maturity Date or a Payment Arrangement's Final Payment Date, whichever date is the latest. Default Interest will continue to be charged where applicable. |

| Charge as Default | Select to charge all Interest as Default Interest once the Account reaches it's Maturity Date, or a Payment Arrangement's Final Payment Date, whichever date is the latest. This effectively displays normal Interest as zero percent and will charge the full Default Interest rate on the Account's Balance. |

Update Interest Cycle from Payment Cycle?

If this is ticked, the Interest Cycle and the Payment Cycle will match, so long as they start the same. For example, if the Payment Cycle is weekly, the Interest cycle will be weekly also.

Align first Interest date to first Payment date?

When ticked the first Interest date will be aligned to the first payment date. Interest is usually charged the day before a Payment is due and would normally be used in conjunction with the "Update Interest Cycle from Payment cycle?".

Comparison Rate options

This functionality is primarily designed for the Australian National Consumer Credit Protection (NCCP) Act Comparison Rate requirement and applies to Fixed Term Loans. For more information about the use of Comparison rates and configuration click here.

Type

Select from the dropdown list one of the following:

| Option | Description |

|---|---|

| None | The default setting; the comparison rate is not calculated or shown on the Account. |

| Actual Days | Uses the actual number of days in the period. |

| Finance Rate | Uses the Finance Rate. |

| Australian NCCP | Australian NCCP uses Annual Rate / 12 (for monthly), / 26.09 (for fortnightly), / 52.18 (for weekly). |

| Custom | Can be customised to any requirement. |

Round digits

Enter the number of digits to round to.

Max Rate

Enter the Maximum percentage.

Next Max Rate

Enter the next Maximum percentage.

Show Zero value Interest Transactions?

Tick to show Zero value Interest Transactions. You should consider unticking this checkbox for Precomputed Interest Loans where Interest is charged upfront and for SACC Loans in Australia.