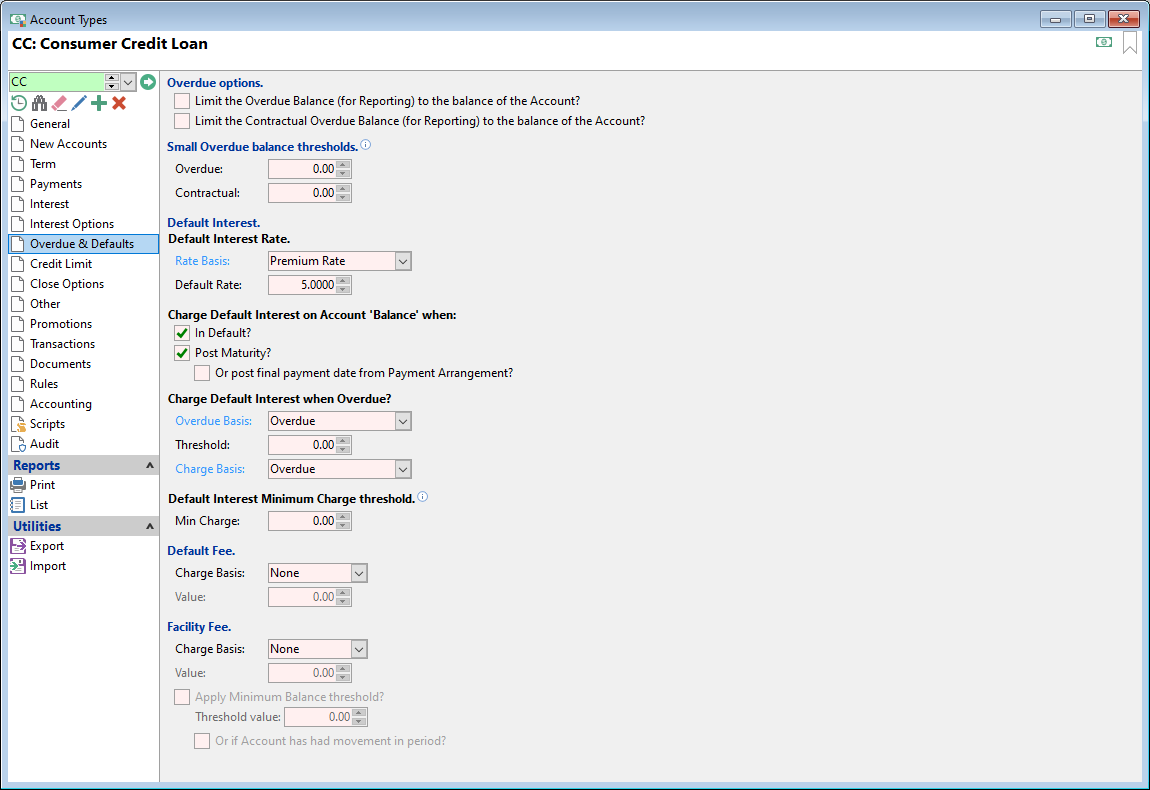

"Limit the Overdue Balance (for Reporting) to the balance of the Accounts?" and "Limit the Contractual Overdue Balance (for Reporting) to the balance of the Account?"

When unticked the sum of Overdue from Transactions is reported as the Overdue Balance, even if it is higher than the Balance.

When ticked, the Overdue Balance is calculated as the sum of Overdue from Transactions and should never show as more than the Balance.This change affects areas such as the Overdue and Contractual Overdue values shown on the Summary Page of the Status page, and various Reports including the Loan Trial Balance Report.

Overdue

Enter an "Overdue" amount for charging default interest. If the Overdue Balance is equal to or below this value then default interest will not be charged for the period and is moved to the next oldest overdue balance.

Contractual

Enter a "Contractual Overdue" amount for charging default interest. If the Contractual Overdue Balance is equal to or below this value then default interest is not charged for the period and is moved to the next oldest contractual overdue balance.

Default Interest Rate

Select the Rate Basis for default interest and enter the Default Rate; select the Rate Basis according to the explanation below.

- Fixed Rate - will charge default interest on the difference between the default rate and the normal interest rate (set on the Interest page) for the account. E.g. if the interest rate is 20% and the default rate is 25%, the Default Interest charged will be 5%.

- Premium Rate - will charge default interest above the normal interest rate (set on the Interest page). E.g. if the interest rate is 12% and the default rate is 10%, the Default Interest charged will be 10%.

- Plus Rate - will charge default interest at a rate calculated as the normal interest rate (set on the Interest page) plus the Plus Rate. E.g. if the interest rate is 12% and the default rate is 10%, Default Interest charged will be 22%.

Charge Default Interest on Account 'Balance' when:

Select from the following options:

- Tick In Default? to charge default interest on the balance when the Account is in non-financial default (for more information about "non-financial" default see note below).

- Tick Post Maturity? to charge default interest on the balance when the Account is post Maturity.

- Tick Or post final payment date from Payment Arrangement? to charge Default Interest on the Account balance either post Maturity or post the last Payment Arrangement's final payment date, whichever is later.

Charge Default Interest when Overdue?

- Overdue Basis - Select the basis that should be used when calculating Default Interest. The options are:

| Basis | Description |

|---|---|

| None | Will not charge Default Interest |

| Contractual Overdue | Calculates Default Interest based on the Account's originally contracted schedule of payments. This means that Default Interest will be calculated based on the original schedule even if the Payment Schedule is adjusted during the life of the Account. An Account Restructure will create a new Contractual Schedule. |

| Overdue | Calculates Default Interest based on the current repayment schedule. This means that the Default Interest will be charged based on the schedule of payments after a Payment Arrangement has been made, or any transactions have been posted that affect the Overdue Balance. |

- Threshold - If the Contractual or Overdue for the period is less than this value, it will not be treated as overdue.

- Charge Basis - select whether Default Interest is to be charged on the Account Balance or Overdue/Contractual Overdue Balance. The options for Charge Basis will differ depending on the selection made in Overdue Basis above.

Default Interest Minimum Charge threshold

Minimum Charge - no Default Interest will be charged if the calculated Default Interest value for this period is less than the value entered here.

Charge Basis

By selecting anything other than "None", a value can then be entered. Default Fees are always charged at the same time as Interest and Default Interest. Charge Basis options are:

- None - no Default Fee will be charged.

- Per Charge - is a flat fee that is charged when the Account has been in arrears at any time during the interest period irrespective of the number of days in the current period.

- Per Day - is the amount that will be charged for each day the Account is Overdue and will be charged at the end of the current Interest period. E.g. if the Default Fee value is 50 cents Per Day, and the Account is Overdue for 3 days in the interest period, the Default Fee will be $1.50.

- Per Month - is the per Month fee amount and will be charged at the end of the current Interest period. E.g. if the Default Fee is $15.20 Per Month and the Interest frequency is Weekly, then the Default Fee will be charged at $3.50 at the end of each weekly interest period during which the Account is Overdue for at least one day (15.20 * 12 months / 365 * 7 days).

Facility Fee

A Facility Fee (using an element defined on the Accounting Page) is charged to the Account in the same period as Interest. The amount charged is defined as below.

Charge Basis

Options are: None, Per Charge, Per Month, Per Day. By selecting anything other than None, a Facility fee amount will be charged.

- None - will not charge anything.

- Per Charge - is a flat fee that is charged per the Interest frequency and irrespective of number of days in the current interest period.

- Per Month - will charge the Facility Fee based on the amount calculated proportionally over the interest period, e.g. a charge of 50 cents per day to an Account which charges interest Weekly will be charged a $3.50 Facility Fee each week.

- Per Day will charge the Facility Fee based on the amount calculated proportionally over the interest period, e.g. a charge of 50 cents per day to an Account which charges interest Weekly will be charged a $3.50 Facility Fee each week.

Value

Enter the value of the Facility Fee to be charged.

Apply Minimum Balance threshold?

Tick to provide a "tolerance" level for NOT charging the facility fee where the balance is lower than the threshold.

Threshold value

Enter a "threshold" value for charging a Facility Fee. If the balance is equal to or below this value then the facility fee will not be charged for the period.

Or if Account has had movement in period?

Tick if the Facility Fee is to ONLY charge the Account if there is movement and the Account has not had a zero or credit balance within the Interest period.