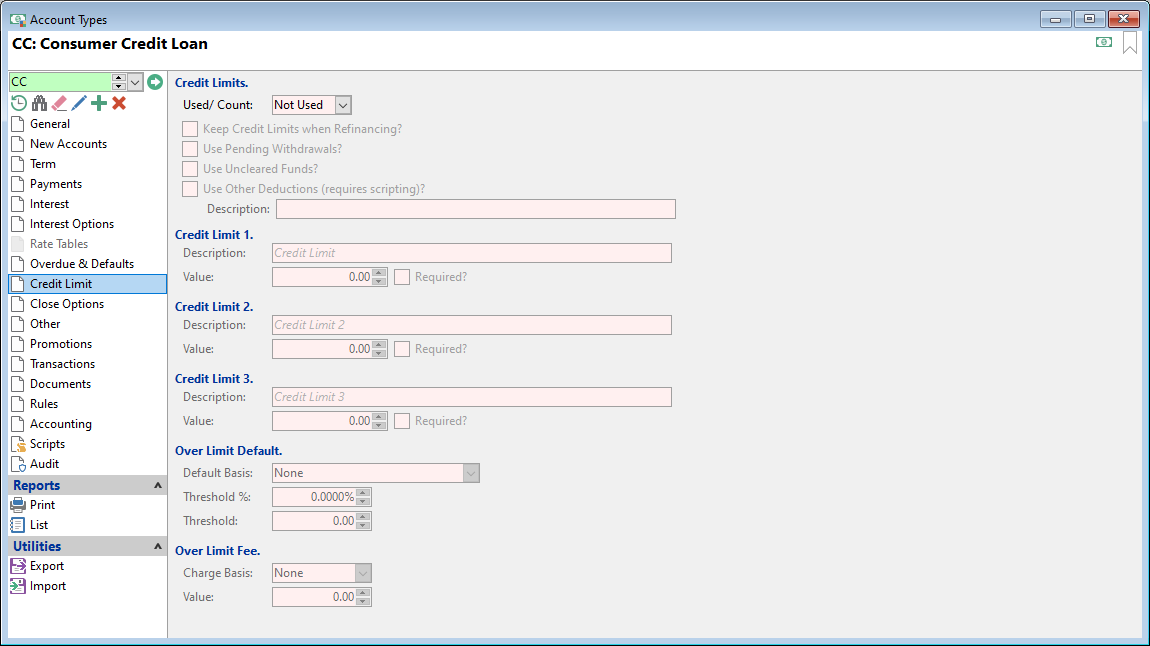

This page covers the options available on the Account Type Settings, Credit Limit page. Beneath the image you will find brief descriptions of the relevant check boxes and fields.

Used/Count

Select if and how many Credit lLimits are to be used per account.

Keep Credit Limits when Refinancing?

Tick to keep the Credit Limits from the original Account's Limits when Refinancing a Loan Account.

Use Pending Withdrawals?

Tick if Accounts of this type use Pending Withdrawals.

Use Uncleared Funds?

Tick if Accounts of this type use Uncleared Funds when calculating available credit.

Use Other Deductions (requires scripting)?

Tick if Accounts of this type use Other Deductions; will require scripting if used.

Description

Enter the Credit Limit description; up to 50 characters.

Value

Enter the value of the Credit Limit.

Description

Enter the Credit Limit description; up to 50 characters.

Value

Enter the value of the Credit Limit.

Description

Enter the Credit Limit description; up to 50 characters.

Value

Enter the value of the Credit Limit.

Required

Tick to make the Credit Limit 3 field mandatory when opening an account.

Default Basis

Select from the dropdown list the basis to calculate the over Credit Limit basis.

| Default Basis | Description |

|---|---|

| None | To have no over limit charge. |

| Balance | Credit Limit - Balance = $$ Over Limit |

| Balance less Interest | Credit Limit - Balance - Interest Balance = $$ Over Limit |

| Balance less Interest/Fees | Credit Limit - Balance - Interest Balance - Fees Balance = $$ Over Limit |

Threshold %

Enter a percentage that credit can be exceeded by before it is in default.

Threshold

Enter a "Threshold" amount for charging default interest. If the Balance is equal to the Credit Limit plus the threshold or below this value then default interest is not charged for the period.

Charge Basis

Select from the dropdown list the Charge Basis. The options are, None, Per Charge, Per Day or Per Month. By selecting anything other than None, a Default fee amount must be entered.

Per Charge is a flat fee that is charged if the loan has been in arrears at any time during the interest period irrespective of number of days in the current period.

Value

Enter the value of the default fee to charge.