This report shows the break down of Interest and Withholding Tax.

- The top half of the report showing a breakdown of Gross Interest and Withholding Tax, will only populate if the Tax Certificate has been run via the menu option, Process, Generate Tax Certificates.

- The lower half of the report showing the Tax Period Breakdown will only be populated with the Tax Periods that have been closed. To find out how to do this click here.

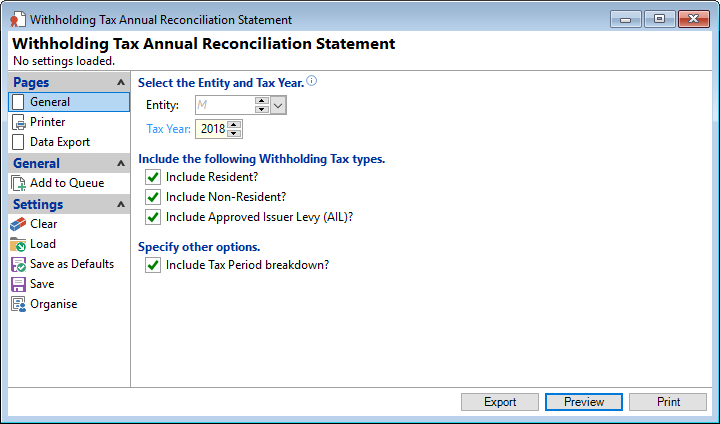

Entity

Select an Entity Id from the dropdown list. If licenced for Entities and there is more than one Entity within the database this is mandatory.

Tax Year

Select the Tax year.

Include the following Withholding Tax types

- Include Resident - Tick to include values for Clients that are Residents.

- Include Non-Resident - Tick to include values for Clients that are Non-Resident.

- Include Approved Issuer Levy (AIL) - Tick to include values for Approved Issuer Levy.

Specify other options

- Include Tax Period breakdown - Tick to include the Tax Period Breakdown. If Tax Periods have not been closed for the Tax year, there will be nothing to show in this area.