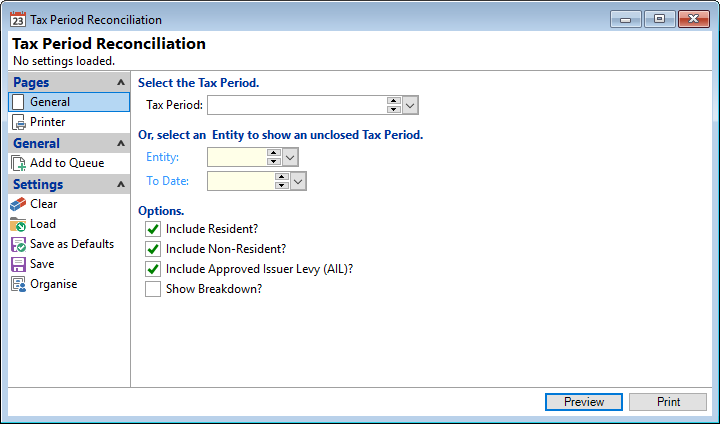

Tax Period

Select the closed Tax Period from the dropdown or leave blank to process an unclosed Tax Period Reconciliation report.

Entity

Select an Entity from the dropdown. If licenced for Entities and you have more than one Entity within the database this is mandatory.

Include Resident?

Tick to include a summary of the resident withholding tax in the report. This includes the IRD number, Period Ended and RWT deducted from interest.

Include Non-Resident?

Tick to include a summary of the non-resident withholding tax in the report. This includes the IRD number, Period Ended and NRWT on interest.

Include Approved Issuer Levy (AIL)?

Tick to include a summary of the Approved Issuer Levy in the report. This includes the IRD number, Period Ended, Total interest paid and amount of interest zero rated.

Show Breakdown?

Tick to include the breakdown in the report.