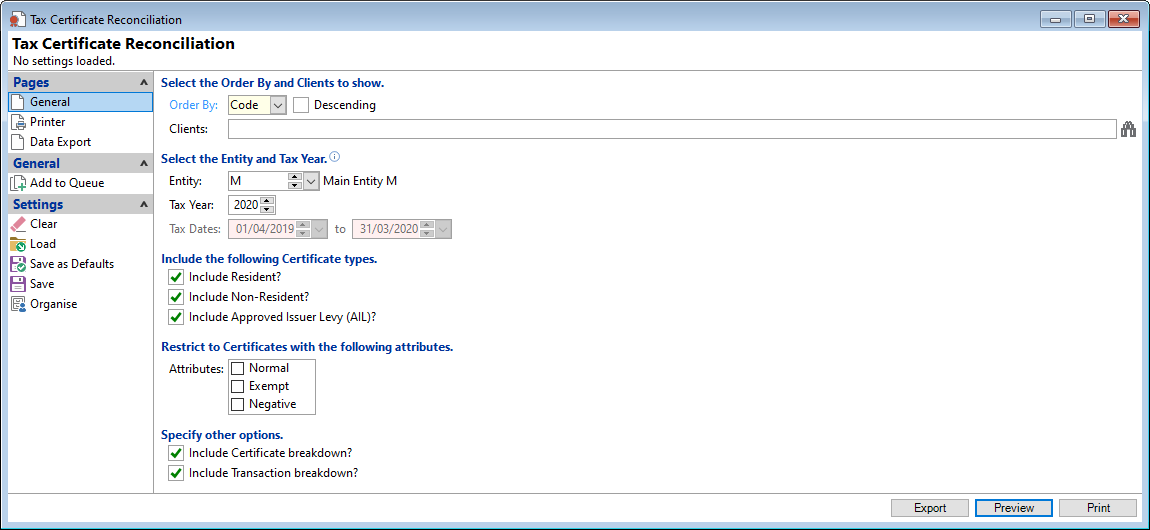

Order By

Select the order the report is to appear.

Descending

Tick to display in a descending order or leave blank to display in an ascending order.

Clients

Select the Clients to be included or leave blank to include all.

Entity

Select an Entity Id from the dropdown list, to report on. If licenced for Entities and you have more than one Entity within the database this is mandatory.

Tax Year

Select the Tax year.

Include the following Certificate types

Tick the checkboxes to include the following in the report:

- Include Resident - clients that are Resident.

- Include Non-Resident - clients that are Non-Resident.

- Include Approved Issuer Levy (AIL)

Attributes

Tick Normal, Exempt and/or Negative to be excluded from the report.

Specify other options

Tick the checkboxes to include the following in the report:

- Include Certificate breakdown?

- Include Transaction breakdown?