<< Previous | Next >>

Prior to generating the Investment Income Report (IIR) or Tax Certificates for Deposits, you will need to close the Withholding Tax Period.

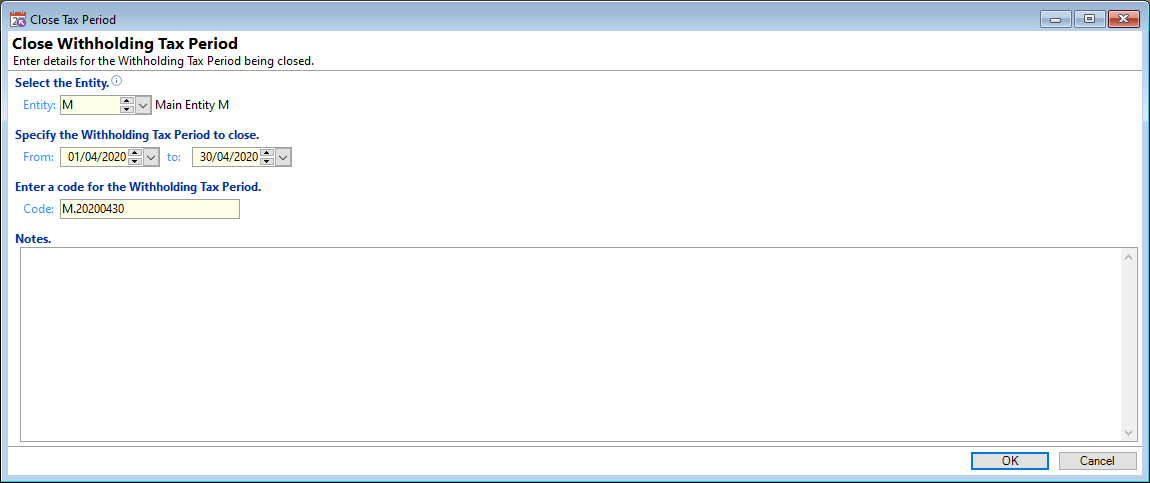

Select the Entity

Select the Entity of the Tax Period from the dropdown list.

Specify the Withholding Tax Period to close

When the form is opened, the From and To dates will default to the most recent open tax period; this is typically the previous calendar month.

If these are not correct then manually enter the date range required.

Enter a code for the Withholding Tax Period

A code will be automatically entered, and will be based upon the Entity Code and Date.

For example M.20200430:

- Entity Code - M

- To Date - 20200430.

The code can be updated if required.

Notes

Enter any notes that are required to appear on the Close Tax Period form.