The Tax Certificate generation process, collates Deposit transactions dated within the Tax Period ready for publishing.

Transactions dated for the current Tax Year are listed on the Tax Certificate. Any transactions that have been backdated to the previous tax year will not be included, these transactions are reported in the End of Year Tax Exception List report and require further attention.

To generate Deposit Tax Certificates

Go to the Menu option Process and select Generate Tax Certificates.

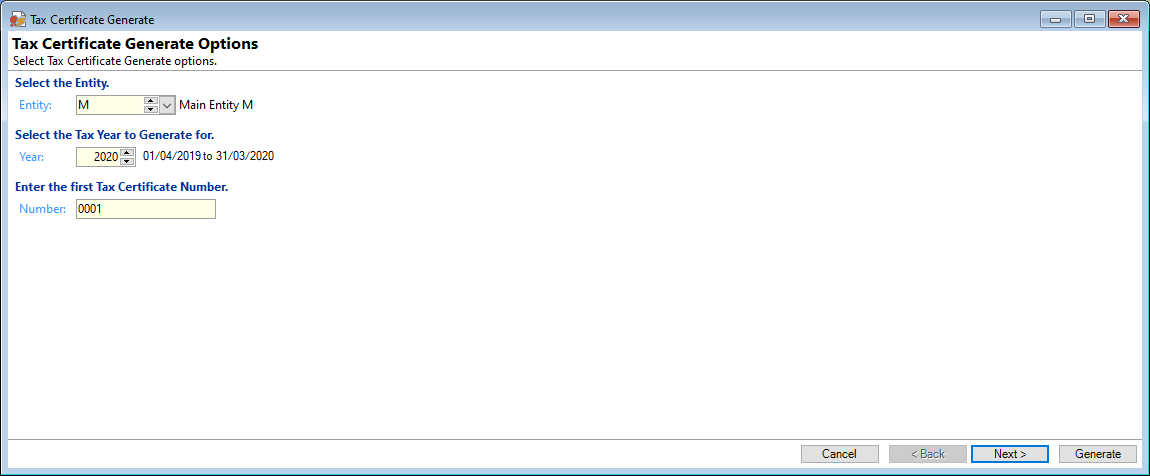

Select the Entity

Select the Entity that the Tax Certificates are to be generated for.

Select the Tax Year to Generate for

Enter or select the Tax Year the Tax Certificates are for.

Enter the first Tax Certificate Number

Enter the first number to identify the Tax Certificates.

Click on the Next  button to move to the next page of the wizard.

button to move to the next page of the wizard.

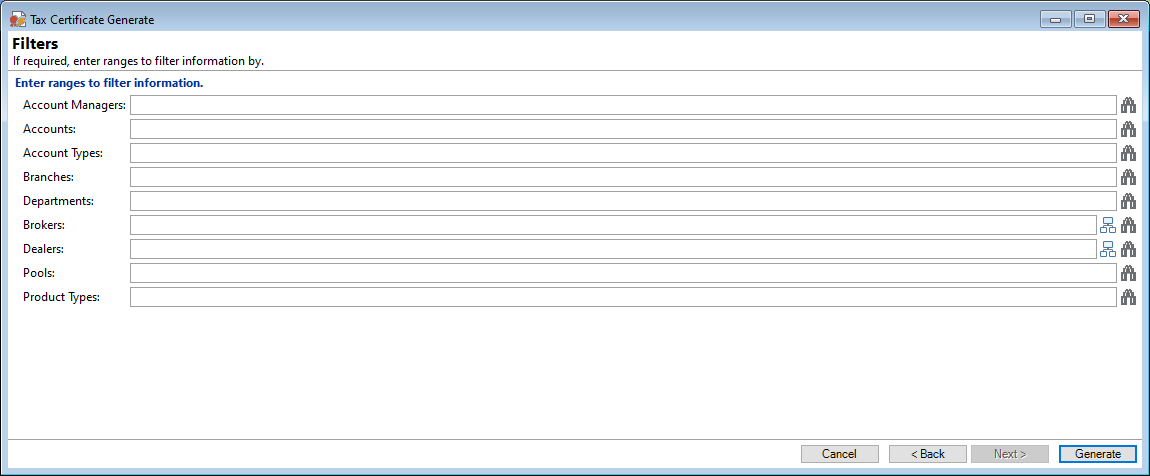

Enter ranges to filter information

Select any ranges to filter by for generating Tax Certificates, or leave blank if not required.

- Click on the Generate

button.

button. - A message "Generate Tax Certificates?" appears. Click Yes to continue or click No to return to the Tax Certificate Generate form.

- The message "Tax Certificates were generated successfully" appears on completion.

Print out a Tax Certificate Reconciliation report from the Report Explorer showing a breakdown of the Credit Interest received for the Tax Year for each Client.

A Tax Certificate document log will be created against the Client Log.

You can publish the Tax Certificate document for Investors via the Client Log or the Publish Documents wizard.