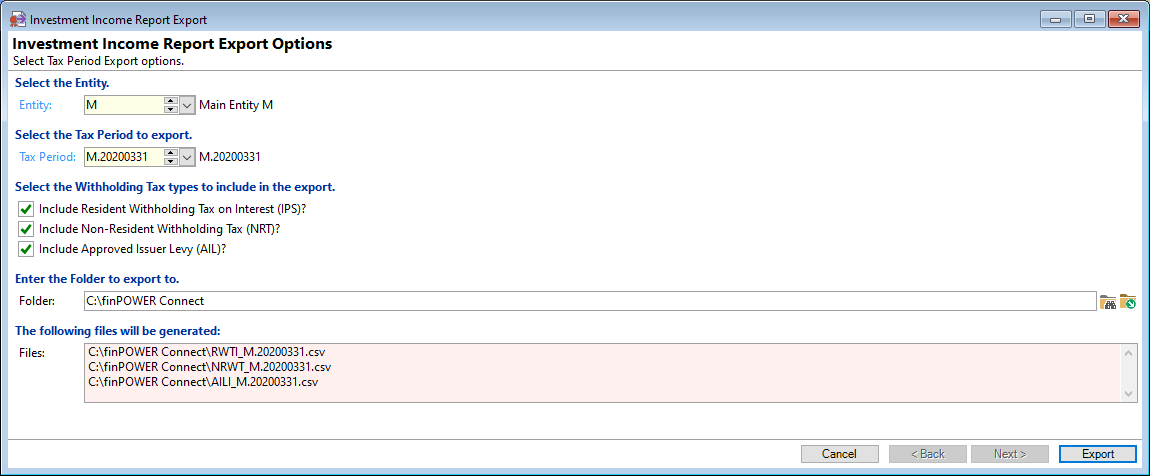

Once the Tax Period has been closed, the Investment Income Report Export can be run.

Select the Entity

Select the Entity of the Tax Period from the dropdown list.

Select the Tax Period to export

Select from the dropdown list the relevant Tax Period to be exported.

Select the Withholding Tax types to include in the export

Tick the relevant checkboxes:

- Include Resident Withholding Tax on Interest (IPS)

- Include Non-Resident Withholding Tax (NRT)

- Include Approved Issuer Levy (AIL)

Enter the Folder to export to

Enter Folder path or browse using the  icon.

icon.

The following files will be generated

The files will be shown according to:

- The Tax Period selected,

- The Tax types selected and

- The Folder entered.

Click the Export  button, to export the files.

button, to export the files.