Report

| Description | The Loan Overdue Report summarises overdue instalments on overdue loans. |

| Purpose | Used to identify the individual instalments which make up the total amount owing on loans. Calculates the actual overdue amount "as at" today based on the payment schedule and takes into account any special repayment arrangements. |

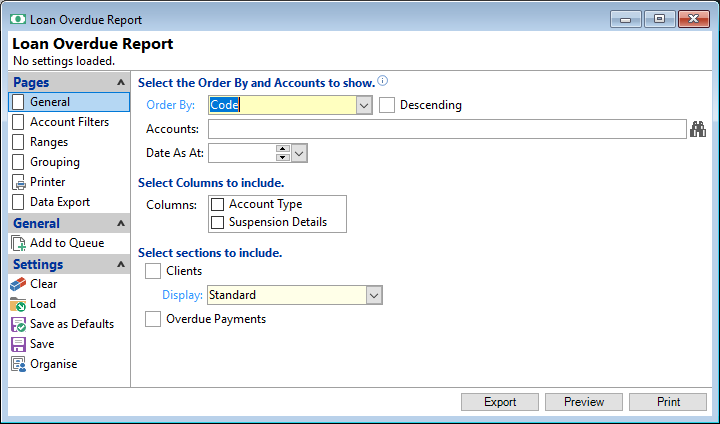

Order By

Select the order in which the report is to appear, by Code, Name, Date Opened, Date Quoted, Overdue, Overdue Days, Contractual Overdue, Contractual Overdue Days, Balance, Next Payment Date, Last Payment Date or Maturity Date.

Descending

Tick to display in a descending order or leave blank to display in an ascending order.

Accounts

Select the Account to be included or leave blank to include all.

Date As At

Enter the date the report will be calculated "to"; used when calculating values such as Balance.

Clients

Tick to include a section of Client details.

Select from the drop down list the way in which this information is to be displayed.

Overdue Payments

Tick to include a breakdown of overdue instalments.

Overdue Days/Dollars - The number of days between the oldest overdue transaction as at a date and the as at date.

- Overdue transactions are calculated based upon the overdue balance as at the date, and working back through transaction overdues until this balance is paid off.

- Additionally, transaction overdues are calculated based upon allocation rules. Payments falling due add to the overdue balance, as is any transaction that is defined as being due immediately, e.g. an ad-hoc fee charged during the term of the Loan.

- Payment transactions can be manually changed but if left to automatically allocate, are paid from the balance of Interest Bearing Fees, Non-Interest Bearing Fees, Interest, Interest Bearing Principal and finally Non-Interest Bearing Principal.

- Overdue transactions can optionally factor in a small balance threshold. If the oldest transaction is less than the threshold it is combined into the next oldest transaction and so on until the oldest overdue transaction is equal to or greater than the threshold.