<< Previous | Next >>

Report

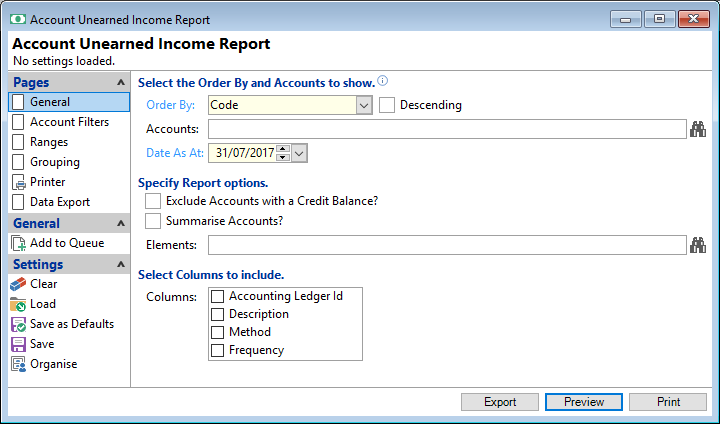

| Description | The Account Unearned Income Report details the unearned income content of Accounting Ledgers of all Accounts at the report date, based on the accounting basis defined on the Account Type. |

| Purpose | This report is used for reporting the Unearned Income required for completing the Company Financial Accounts. |

Order By

Select the order in which the report is to appear, by Code, Name, Overdue, Overdue Days, Balance, Next Payment Date, Last Payment Date or Maturity Date.

Descending

Tick to display in a descending order or leave blank to display in an ascending order.

Accounts

Select the Accounts to be included or leave blank to include all.

Date As At

Enter the date the report will be calculated "to". The 'As At' Date is used when calculating values such as Monitor Categories, Balance and Overdues.

Exclude Accounts with a Credit Balance?

Tick to exclude Accounts with Credit Balances.

Summarise Accounts?

Tick to summarise the elements for each account.

Include a Total Column?

Tick to include a Total column which calculates total of all columns.

Elements

Select the Elements to be included or leave blank to include all.

Columns

Select the applicable columns to be included in the report.