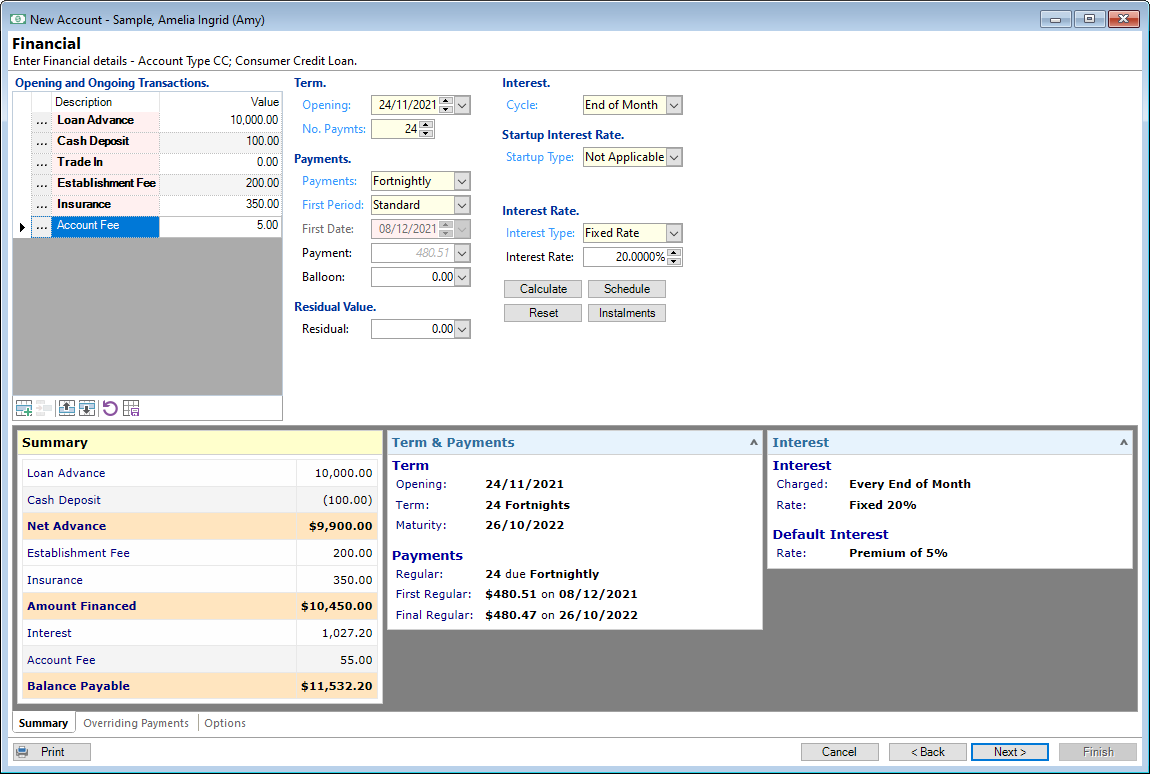

Opening and Ongoing Transactions

Enter the Opening and Ongoing transactions for the Account. Elements and values can be defaulted from the Account Type.

Button Strip

| Icon | Definition |

|---|---|

| Add new Transaction item |

| Delete the currently selected row |

| Move the current row up (Ctrl+Up) |

| Move the current row down (Ctrl+Down) |

| Reset transactions to Account Type defaults |

Opening

Enter the Start Date of the Account, usually the date it was signed or advanced.

Term

Select the term for the Account. The term list will default based upon settings on the Account Type. See topic on Date/Term Formatting for additional information on Date/Term entry.

Payments

Select the payment frequency for the Account. The payment list will default based upon settings on the Account Type.

First Period

Select the first payment period for the Account. The period list will default based upon settings on the Account Type.

First Date

Enter the date the first instalment is due to be paid, the number of instalments of this value is shown along with the regular instalment value. A deferred payment date may also be entered here. Note: First Period is set to On Date.

Payment

Leave the payment value blank to calculate based upon the term and interest rate. Alternatively enter a payment value and the term will be adjusted based upon the payment amount.

Balloon

A balloon value may be entered. This will reduce the regular payments and balloon payment will be due based upon Account Type setting.

Residual

A residual value may be entered. This will reduce the regular payments and leave this value outstanding at the end of the term.

Int Cycle

Select the interest cycle for the Account. The interest cycle list will default based upon settings on the Account Type.

First Date

Enter the date the first date to charge interest on the Revolving Credit Loan.Startup Type

Select the interest cycle for the Account. The interest cycle list will default based upon settings on the Account Type.

Interest Type

Select the interest type for the Account. The interest type list will default based upon settings on the Account Type.

Interest Rate

The interest rate to be used to calculate interest over the preceding number of instalments.

Interest Rate Calculator

Click the  button to calculate the Interest Rate from a known Total Interest amount.

This might be used when matching the Account to an external calculator.

button to calculate the Interest Rate from a known Total Interest amount.

This might be used when matching the Account to an external calculator.

This button will only be available if the Account Type allows calculation of the Interest Rate from Total Interest.

Calculate

Clicking the  button, will calculate the instalments.

button, will calculate the instalments.

To automatically calculate each time a value is changed on the form, tick the option Automatically recalculate Account Financial figures? in User Preferences, Accounts, General Page.

Schedule

Click the Schedule button to show the schedule of payments for the term of the account including interest and principal amounts.

Reset

Click the Reset button to reset the the payments, term and payment frequency to the Account Type defaults.