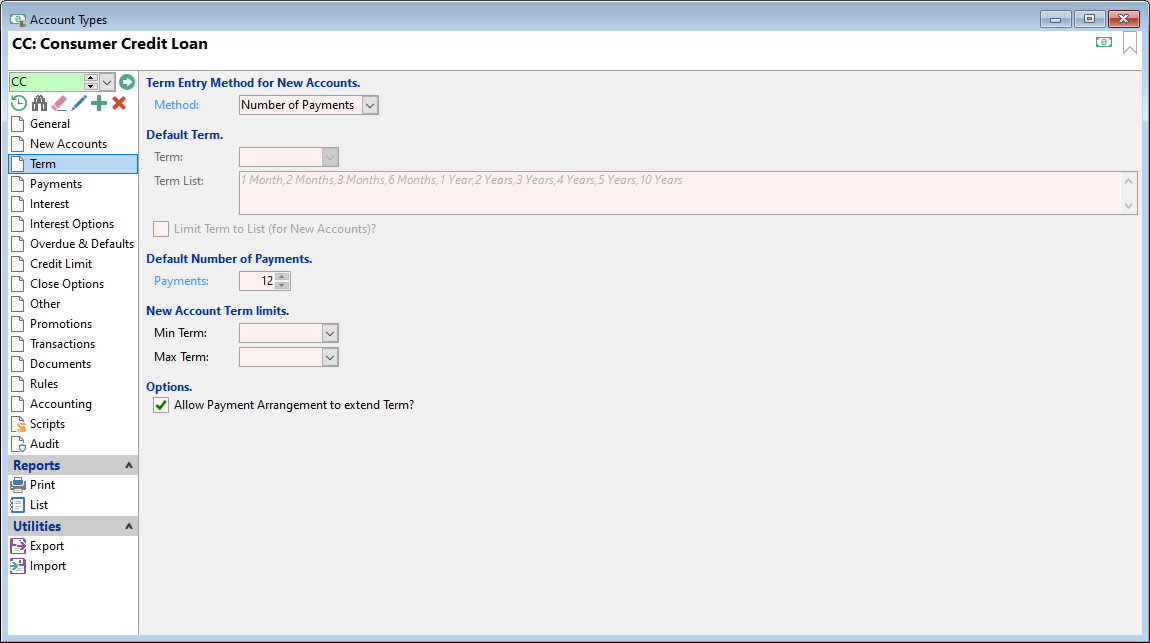

Method

Select from:

- Term - to define the length of the loan (selected further down the page).

- Number of Payments - to define the Term of the Loan to a number of payments (selected further down the page).

Default Term

If "Number of Payments" was selected as the Method, this area will be greyed out.

Term

Select the term that the New Account Wizard will default to.

Term List

Enter a comma separated list of terms to default in the New Account Wizard, i.e., 1 Month, 2 Months, 3, Months, 3 Years etc.

Limit Term to List?

Tick to limit the term selection to the defined list.

Default Number of Payments

If "Term" was selected as the Method, this area will be greyed out.

Payments

Enter the Number of Payments that the New Account Wizard will default to.

Minimum Term

Optionally enter the minimum term for new accounts of this Account Type.

Max Term

Optionally enter the maximum term for new accounts of this Account Type.

Options

Tick the "Allow Payment Arrangement to extend Term?" checkbox, to allow the Account to extend past the current Maturity date in the Payment Arrangement wizard.

Additionally, there is a permission key that when switched on, allows the user to proceed regardless of this Account Type setting. The permission key is Account.PaymentArrangementAllowFinalPostMaturity.