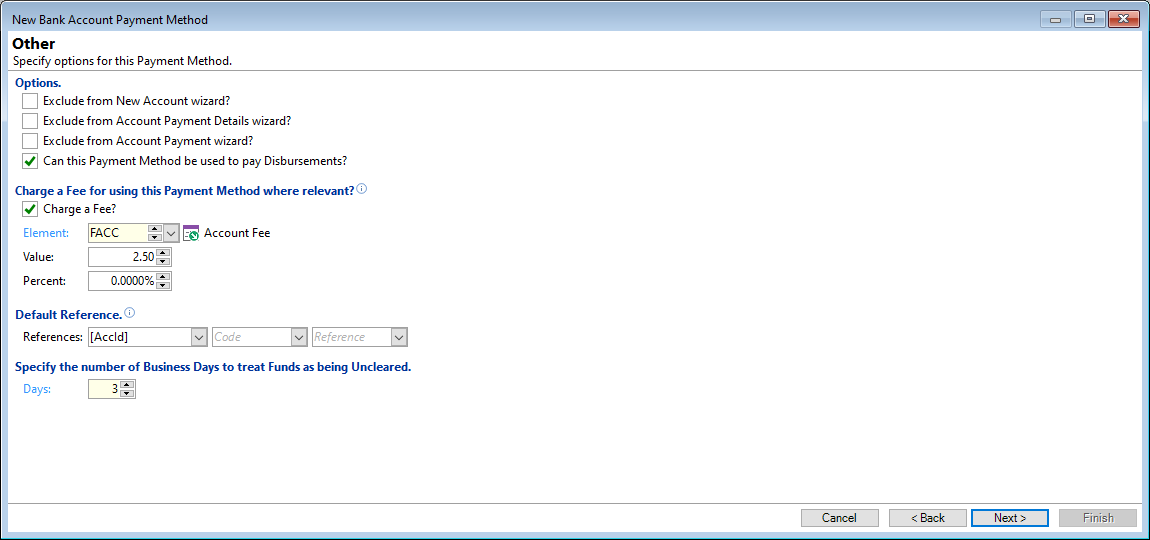

Exclude from New Account Wizard?

Tick to exclude this Payment Method selection when adding a New Account. This will still allow the Payment Method to be selected in the Account Payment Received wizard and Bank Entry.

Exclude from Account Payment Details wizard

Tick to exclude this Payment Method selection when editing the Payment Details on the Account, Payments Page.

Exclude from Account Payment wizard?

Tick to exclude this Account Payment Method selection when adding an Account Payment.

Can this Payment Method be used to pay Disbursements?

Tick where this Payment Method can be used to pay Disbursements.

Charge a Fee?

Tick to charge a fee for payments using this Payment Method, but ONLY via the Payment Received wizard.

Element

Select the Element to be used when the fee is posted.

Value

Enter the value of the fee to be posted or leave blank to use a Percent.

Percent

Enter the Percentage used to calculate the Fee or leave blank to use a Value.

The fee is calculated on the Gross value of the payment plus fee, e.g. a $100 payment with a Percentage Fee of 2% will generate a Fee value of $2.04 ($102.00 X 2% = $2.04).

To have the Fee as 2% of the net payment value, calculate the Fee Percentage using the following formula:

Percentage Rate = Rate / (1 + Rate)

For example 0.02 / (1.00 + 0.02) = 0.01961 or 1.961%. Using our example payment of $100, this will generate a fee of $2.00 ($102 X 1.961% = $2.00).

References

Enter the default "Particulars;Code;Reference" information for the Payment Method. These are the default Bank references when entering Direct Debits, Disbursements and other Transactions.

Additionally the following Smart Tags can be used:

- [AccId] - Account Id

- [AccName] - Account Name

- [ATId] - Account Type Id

- [ATCode] - Account Type default Reference Code

- [ExtId] - External Id

Days

Specify the number of Business Days to treat Funds received of this Payment Method as Uncleared. An example of why this is used: Cheques need time to clear or where there are not enough funds, time to dishonour.

If a value of 3 days is entered then;

day 0 = Transaction day

day 1

day 2

day 3 - cleared funds.

These days will exclude any non business days including holidays as defined within the Calendar.