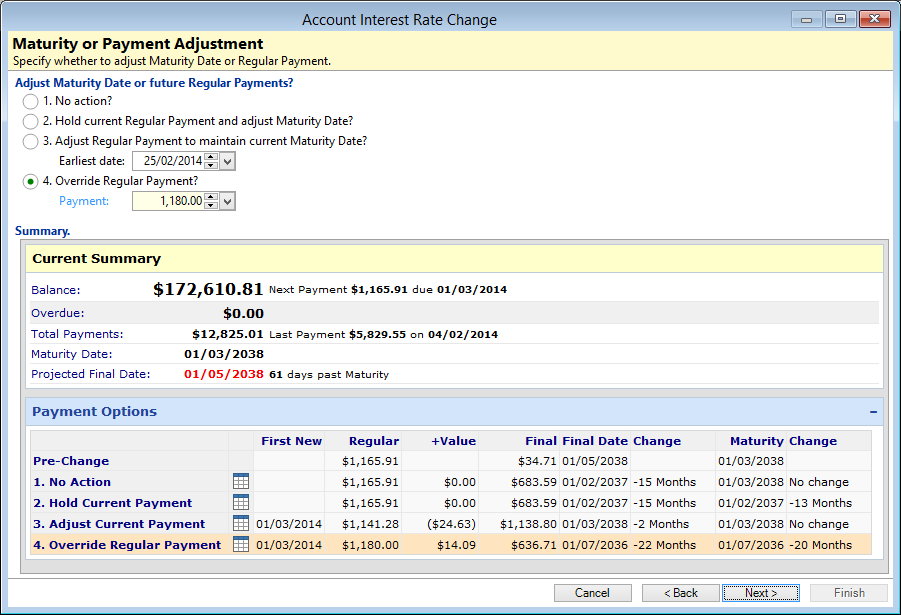

Adjust Maturity Date or Future Regular Payments?

There are four options for how the future payment schedule should be structured after this Interest Rate Change has been actioned. Select one of the following options:

No Action?

This option will keep the regular repayment amount the same as it is currently, and it will not change the Maturity Date. This will allow for any pre-paid balance to be retained and available to cover any future instalments.

Hold current Regular Payment and adjust Maturity Date?

This option will keep the regular repayment amount the same as it is currently and adjust the maturity date as calculated.

Adjust Regular Payment to maintain current Maturity Date?

Change the regular repayment (increase/decrease) so that the account will be repaid on the current Maturity date.

Earliest date

Enter the Earliest date that payments can be adjusted from. This allows a grace period before the repayment value changes so the client can be notified of the change and has time to adjust their payment. Some clients may need to be advised that the interest rate is changing as at a date and that the repayment amount is changing. This can be defined on the Account Type's Interest Options.

Override Regular Payment?

Select to define a new repayment amount yourself and have this change the final payment date. If the final payment is after the current Maturity Date, default interest may be charged Post-Maturity.

Summary

The Summary displays the current Account information. The Payment Options section displays whether there will be an increase or decrease in the regular repayment amount, final payment amount and date when each of the options is selected.