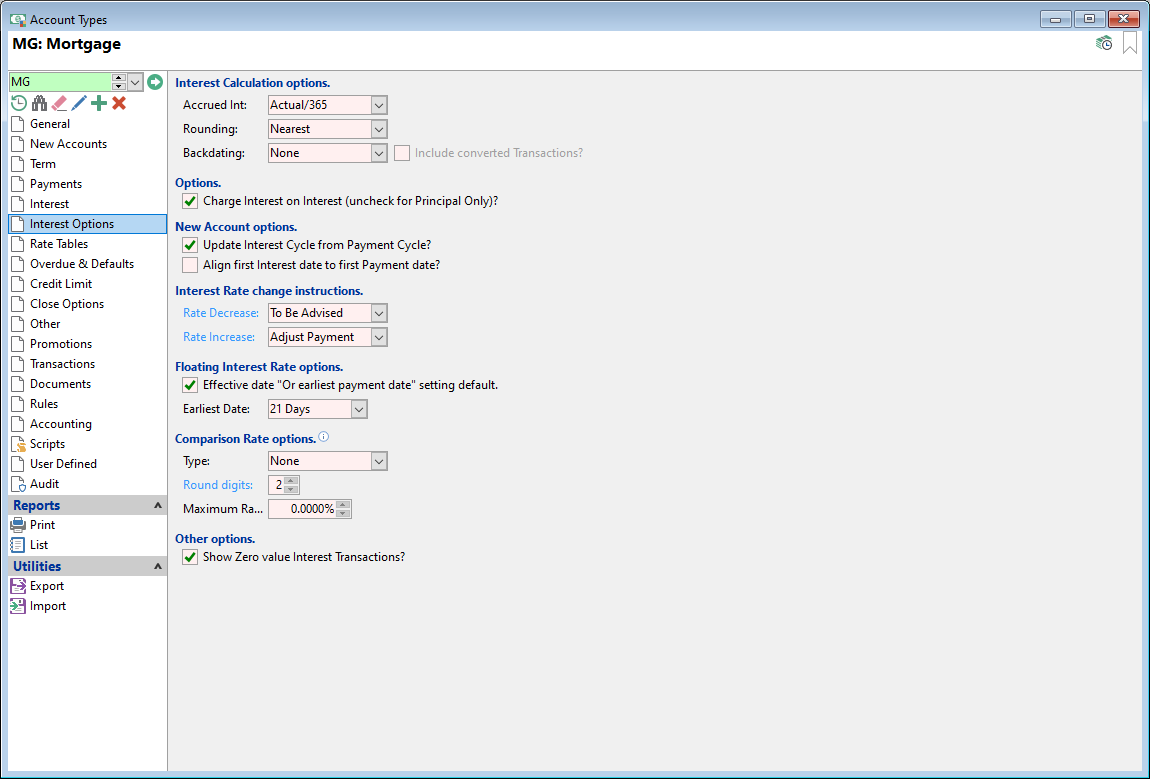

Accrued Int

| Method | Description |

|---|---|

| Actual/Actual | Daily balance * Interest Rate / number of actual days within the Calendar year |

| Actual/360 | Daily balance * Interest Rate / 360 * number of days |

| Actual/365 | Daily balance * Interest Rate / 365 * number of days |

| Annualised |

Daily balance * Interest Rate / number of actual days within the Calendar year then divided by 12. For example, if charging a whole month's interest, instead of taking the total of each day's daily interest an annualised value is calculated and then divided by 12. This means the same interest will be charged irrespective of the month having 30 or 31 days. Interest Cycle - Quarterly: Interest is calculated slightly different to weekly/monthly. Example: Opening Date: 05/08/2010, Loan Advance: $1,500.00, Term: 12 months, Payments: Monthly, Interest Rate 17%, Interest Cycle: Quarterly. On the interest audit for the end of October, the first period of interest (5 August to 4 September) is calculated as follows: $1500 x 17%/12/31 x 27 =$18.5081 & $1500 x 17%/12/30 x 4 =$2.8333. Total interest is $21.3414 = $18.5081 + $2.8333. |

Rounding

If the Interest calculated for the period was $45.5675, this would be rounded based upon the setting below.

| Method | Description | Actual Interest Charge |

|---|---|---|

| Nearest | Select to round the Interest to the nearest currency value. | $45.57 |

| Down | Select to round the Interest down to the nearest currency value. | $45.56 |

| Up | Select to round the Interest up to the nearest currency value. | $45.57 |

Backdating

Optionally select to have the Automatic Processes facility reverse all Interest and related Fee transactions for the period starting when a backdated transaction was posted. It also resets the "Last Charged" date for Interest back to this date. Then Automatic Processes facility will then re-charge the Interest and Fees based on the new balances.

| Option | Description |

|---|---|

| None | Interest and Fees will not be re-calculated if a transaction is backdated past the Interest Charged To date. |

| Tracking Only | Interest and Fees will not be recalculated, but the date of the backdated transaction will be recorded so that you can report on Accounts which have had backdated transactions in this interest period. The Backdated Transaction record will be removed the next time Interest is charged, so it is important to perform any actions required before processing interest again. |

| Reverse | Interest and Fees will be re-calculated if a transaction is backdated past the Interest Charged To date. |

Include converted Transactions?

If Interest and Fees are being reversed and re-charged when transactions are backdated, check for transactions with an Element Type of 'Interest' and a Source of 'Converted' to also be reversed and re-charged.

Charge Interest on Interest (uncheck for Principal Only)?

Define if interest is to be charged on any unpaid Interest. If the Account Type is for Principal Only loans, this option should be left un-ticked.

Charge precomputed Contractual Interest during normal Term?

Tick this box to charge Interest to the Account based on the original interest schedule, no matter what the Account's daily balance. This means that Interest will be charged according to the Opening Schedule, even if payments are made earlier or later than originally scheduled.

Charge precomputed Contractual Interest charged upfront?

Tick this box if you want the total interest to be added to the loan on Opening date, allowing interest charges to be treated like other upfront costs. This means the precomputed Contractual Interest is charged to the Account and does not vary if a payment is paid early or late, ie the Interest is fixed and charged when the Account is opened.

The Opening (original) Financial Schedule of the Account shows the Interest to be charged each Interest Period, so a full breakdown of Interest calculations is available. The ongoing Financial Schedule of the Account still shows each Interest charged at the end of each Interest period - but the Interest value is zero.

Post Maturity

| Method | Description |

|---|---|

| Charge | Select to continue charge Interest & Default Interest once the Account reaches it's Maturity Date or a Payment Arrangement's Final Payment Date, whichever date is the latest. |

| Do not Charge | Select to SUPPRESS all normal Interest charges once the Account reaches it's Maturity Date or a Payment Arrangement's Final Payment Date, whichever date is the latest. Default Interest will continue to be charged where applicable. |

| Charge as Default | Select to charge all Interest as Default Interest once the Account reaches it's Maturity Date, or a Payment Arrangement's Final Payment Date, whichever date is the latest. This effectively displays normal Interest as zero percent and will charge the full Default Interest rate on the Account's Balance. |

Interest and Default Interest Rates Charged based upon options defined

| Interest Rate | Premium 10% | Fixed 25% | Plus 12% | ||

|---|---|---|---|---|---|

| Charge | Start-Up | 2% | 10% | 23% | 14% |

| Before Maturity | 15% | 10% | 10% | 27% | |

| After Maturity | 15% | 10% | 10% | 27% | |

| Do Not Charge | Start-Up | 2% | 10% | 23% | 14% |

| Before Maturity | 15% | 10% | 10% | 27% | |

| After Maturity | 0% | 10% | 10% | 27% | |

| Charge as Default | Start-Up | 2% | 10% | 23% | 14% |

| Before Maturity | 15% | 10% | 10% | 27% | |

| After Maturity | 0% | 25% | 25% | 42% |

Update Interest Cycle from Payment Cycle?

If this is ticked, changing the Account's payment cycle will also change the cycle Interest is charged. Changing the Interest Cycle will not affect the Payment Cycle, so you may still change the Interest Cycle back to it's original value if you choose to.

Align first Interest date to first Payment date?

When checked the first Interest date will be aligned to the first payment date. Interest is actually charged to the day before the Payment is due and would normally be used in conjunction with the "Update Interest Cycle from Payment cycle?".

Rate Decrease / Increase

Fixed Term Floating Rate Accounts have an "Interest change" instruction that is used when a Rate Increases or Decreases.

Select the default Instructions for when the Account has an Interest Rate change. Additionally, these can be updated on an Account from the Accounts Form, Financial page where necessary.

The options are:

| Type | Description |

|---|---|

| Adjust Payment | Adjust (increase/decrease) the regular payment to maintain the current Maturity Date. |

| Hold Payment | Hold the current regular payment and adjust(increase/decrease) the Maturity Date. |

| To Be Advised | Borrower must advise an instruction for each change. Leaving the instructions as 'To Be Advised' will hold the rate change increase/decrease as Pending waiting for the instructions. |

Effective date "Or Earliest Payment Date" setting default

If the checkbox Effective date "Or earliest payment date" setting default is ticked, then the corresponding checkbox on the "Bulk Floating Interest Rate Change" wizard will also be ticked. This enables the user to enter the earliest date a payment can be adjusted.

The rate change effective date will be delayed until the first payment at the new rate, so does not change mid interest period.

If an Account is within a non-floating interest rate period (Fixed or Rate Table) then the effective date is forced on to the end of that period. Click here for more information.

Earliest Date

Enter the the Earliest Date, e.g. 21 Days. This will default the "Earliest Date" from today on the Floating Interest Rate Change wizard. Click here for more information.

Comparison Rate Options

This new functionality is primarily designed for the Australian National Consumer Credit Protection (NCCP) Act Comparison Rate requirement and applies to Fixed Term Loans.

Type

| Option | Description |

|---|---|

| None | This is the default setting. The comparison rate is not calculated or shown on the Account. |

| Actual Days | Actual uses the actual number of days in the period. |

| Australian NCCP | Australian NCCP uses Annual Rate / 12 (for monthly), / 26.09 (for fortnightly), / 52.18 (for weekly). |

Usage

When entering a New Loan the Financial page summary will show a new Comparison Rate block. This displays the calculated Comparison Rate and Maximum Rate, as defined on the Account Type, as well as a warning if it exceeds the maximum.

Account Warnings includes a new fail warning if the Maximum Rate is exceeded. Note, you have to add and configure the Account Warnings script for this page to show.

Quotation documents includes a section showing the Comparison Rate and on an existing Account the Comparison Rate is shown on the Financial Page, "Opening" row. Full audit details are saved and can be seen on the Audit page of the Account form.

Show Zero value Interest Transactions?

Tick to show/hide Zero value Interest Transactions. You should consider unticking this checkbox for Precomputed Interest Loans where Interest is charged upfront and for SACC Loans in Australia.