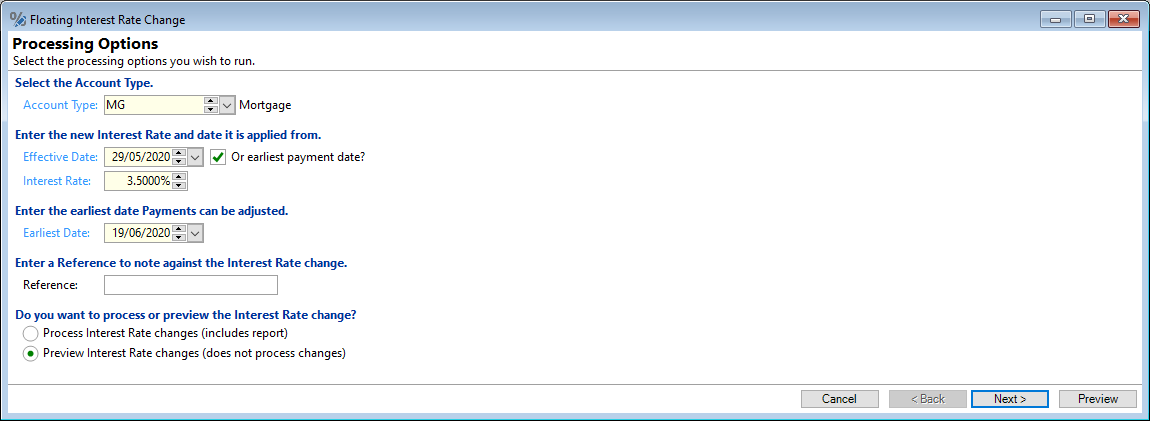

Select the processing options you wish to run.

Select the Account Type

Select the Account Type from the list.

This list will be restricted to the Account Class 'Floating Rate Loan'.

Effective Date

Enter the date the change should be effective from.

Or earliest payment date?

If ticked the rate change effective date will be delayed until the first payment at the new rate, so does not change mid interest period.

You can set the checkbox default settings on the Account Type Interest Options.

Interest Rate

Enter the new Interest rate.

Enter the earliest date Payments can be adjusted

Enter the Earliest Date that payments can be adjusted. If the account is within a non-floating interest period, this date is forced on to the day after the fixed period ends so payments due after the end of the period will be at the new rate.

A minimum notice period of new payment value may be required. To do this, set the default settings on the Account Type Interest Options page, e.g. 21 days from the 'Effective Date' entered.

Enter a Reference to note against the Interest Rate change

Enter a Reference which can be up to 20 characters.

Process Interest Rate changes (includes report)

Tick to process to immediately update the Account, unless it is left pending.

Reasons the Account will be left pending:

- Instruction is To be Advised.

- There is already a Pending Floating Interest Rate change.

- Next Payment Date is prior to today.

- Calculation failed for some other reason.

Preview Interest Rate changes (does not process changes)

Tick to do a Preview run which will perform all the calculations without actually updating. The Report can then be printed for manual checking.