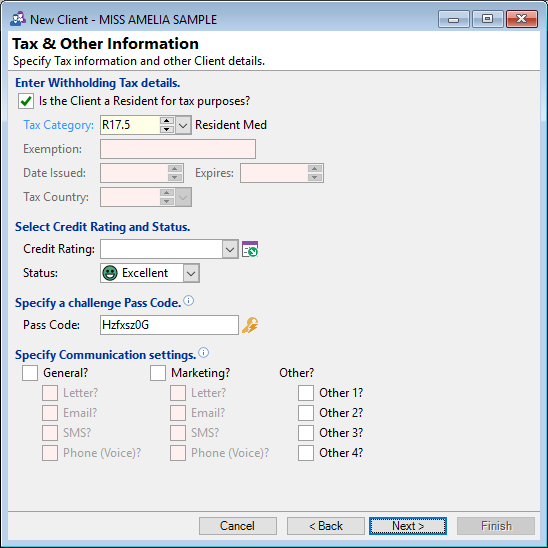

Is the Client a Resident for Tax Purposes?

Check the checkbox if this client is a resident for taxation purposes.

Tax Category

Define the clients tax category from the dropdown list. This will define the withholding tax rates.

Exemption

This is only available if the category is set to Resident Exempt.

If the Client has an Exemption Certificate enter the Certificate number, Date Issued and Expiry Date details.

Tax Country

For Non-Resident Clients select the applicable Country Code from the dropdown.

GST Exempt

Check if this Client is Exempt from GST charges. Eg. A Returned Serviceman and Invalid Beneficiaries may be GST exempt.

Credit Rating

Optionally enter a Credit Rating for this Client.

Status

From the Caution Status dropdown select status. Options are:

| Icon | Status |

|---|---|

| <BLANK> | None |

| Excellent |

| Good |

| Caution |

| Bad |

| Adverse |

| Bankrupt |

Caution Status alerts will alert the user to a Clients status if specified in Tools, User Preferences.

Pass Code

A pass code may be entered and used as a method for the Client to identify themselves. Click  to generate a unique strong pass code for the client.

to generate a unique strong pass code for the client.

Send General/Marketing Communication

Use this setting to specify within your custom VBA's whether this client is to receive general and/or marketing communication.

Other 1, 2, 3 & 4

These Other Communication Flags can be used within your custom VBA's.