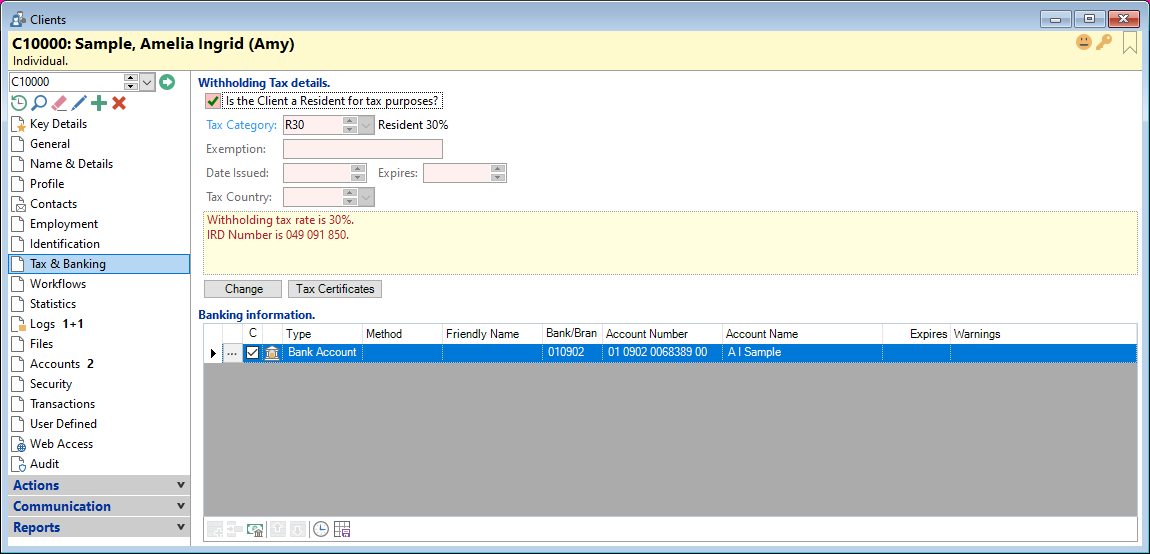

Is the Client a Resident for tax purposes?

Tick the checkbox if the client is a Resident and will potentially be charged Withholding Tax.

Tax Category

Define the Client's Tax Category from the dropdown list. This will define the withholding tax rates.

Exemption

If the Client has an Exemption Certificate enter both Certificate number and Expiry Date details.

Tax Country

For Non-Resident Clients select the applicable Country Code from the dropdown.

Change Button

Click on this button to change the Withholding Tax details for the client.

If this button is shown then all of the Tax fields will be read-only and changes must be made via this button.

If not permission to update Withholding Tax details, these fields will also be read-only. The Permission key is Client.WithholdingTaxUpdate. Click here for more information.

Tax Certificates

Click on this button and this opens a separate form showing a summary of the Client's Tax Certificates.

GST Exempt

Check if this Client is Exempt from GST charges. Eg. A Returned Serviceman and Invalid Beneficiaries may be GST exempt.

For this checkbox to display, you need to tick the Use Goods & Service Tax checkbox in Global Settings, GL and Accounting page.

Banking Information

The banking information holds both current and historic bank accounts for the client.

Columns

| Column | Description |

|---|---|

| Drilldown | Click  to drilldown to the details of the Bank Account. to drilldown to the details of the Bank Account. |

| Method | How payments are to be made. |

| Account Number | The Bank Account from which payments are being made. |

| Account Name | The name of the Bank Account. |

| Bank | The name of the Bank and Branch Name of the Bank Account. |

| Bank/Branch | The number of the Bank and Branch Name of the Bank Account. |

| Created | The date and time the transactions was entered. |

| Creator | The User who entered the transactions. |

| Start | Date the Bank Account was valid from. This may be the date the Bank Account was entered into finPOWER Connect. |

| Stop | If applicable, the date the Bank Account is valid until. This may be a date in the past for expired Bank Accounts, or it may be a date in the future |

| Expires | If applicable, the date the Bank Account will expire. An expiry date can only be set for Bank Accounts with an expiry date, e.g. Credit Cards. |

| Notes | Any applicable notes. |

| Updated | The date and time the transaction was updated. |

| Updater | The User who updated the transaction. |

| Warnings | Displays any warnings applicable to the Banking information. Eg. Invalid bank account number. |

Button Strip

| Icon | Definition |

|---|---|

| Add a new Bank Account & Method. |

| Remove selected rows |

| Copy Bank Account details to Client's Accounts. |

| Move the selected row up (Ctrl + Up) |

| Move the selected row down (Ctrl + Down) |

| Display only the current or active Bank Account details |

| Save the defaults for this grid. |