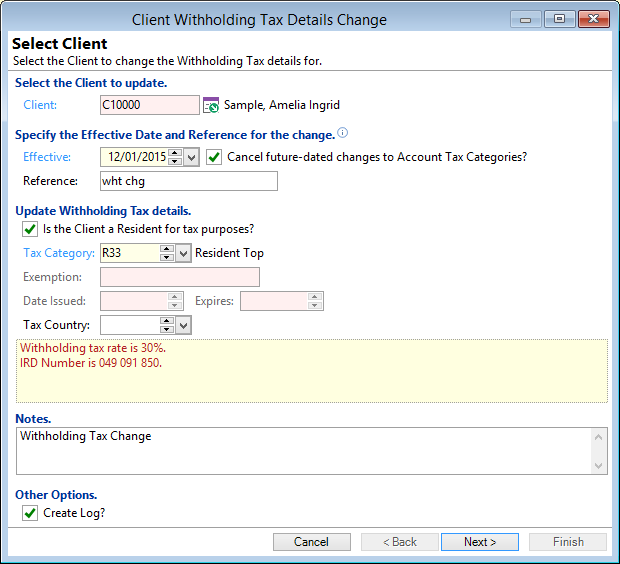

Client

Select the Client to do the update of Withholding Tax details for.

If you opened the Client Withholding Tax Details Change Wizard by clicking on the Change button from the Client form, Tax & Banking page the Client Id will be defaulted here.

Effective

Enter the date the new Withholding Tax Rate will apply from.

Cancel future-dated changes to Account Tax Categories?

Tick to Cancel changes to Account Tax Categories dated on or after the Effective Date.

Is the Client a Resident for tax purposes?

Tick the checkbox if the client is a resident for tax purposes.

Tax Category

Select a Tax Category from the dropdown list of available categories. This list is defined in the Client's Client Type.

Exemption

Enter the Exemption Certificate Number.

Date Issued

Enter the date the Exemption was issued to the client.

Expires

Enter the date the Exemption will expire for the client.

Tax Country

For Non-Resident Clients select the applicable Country Code from the dropdown list.

Notes

Enter any notes applicable to the Withholding Tax Details change.

Create Log

Tick Create Log to create a Log when this change is committed.