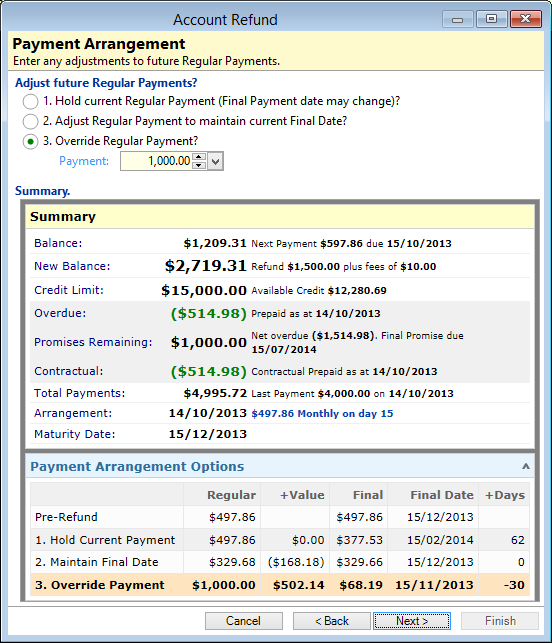

Adjust future Regular Payments?

There are three options for how the future payment schedule should be structured after this Withdrawal has been actioned. Select one of the following options:

Hold current Regular Payment

This option will keep the regular repayment amount the same as it is currently. This means that the loan will not be repaid by the current maturity date and default interest will be applied after maturity, depending on the Account Type's Overdue and Defaults configuration.

Adjust Regular Payment to maintain current Final Date

Change the regular repayment so that the loan will be repaid on the current Final Payment date.

Override Regular Payment

Select a new repayment amount yourself and change the final payment date. If the final payment is after the current Maturity Date, default interest may be charged Post-Maturity.

Summary

The HTML Summary displays the current Account information. The Payment Arrangement section displays whether there will be an increase or decrease in the regular repayment amount, final payment amount and date when each of the options is selected.