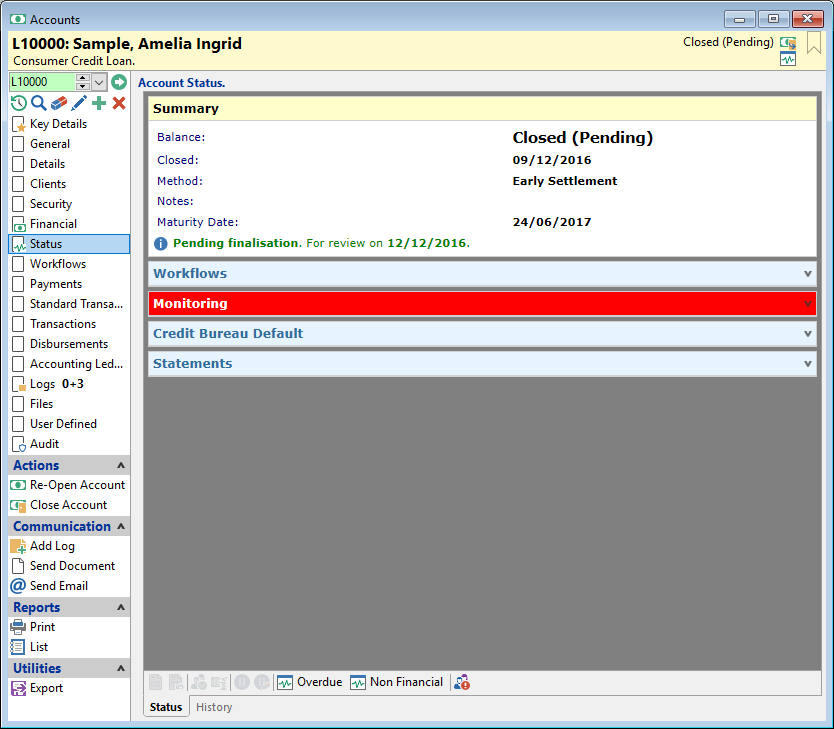

Accounts will default to Closed (Pending) Status if defined by the Account Type.

Closed Pending status means that the Account is not completely closed until the Review Days are passed. During this time, the Account can be easily re-opened and most closing transactions will be reversed, with the exception of Standard Transactions and the Bank Transaction that closed the loan.

The Pending Status would normally be set to at least 3 days to allow for the payment to clear through the bank. You may also wish to leave closed accounts Pending for a period to allow time to market new finance options to your Borrower before discharging any security.

If, during the Pending period, you wish to Re-open or finalise the closure, use the options in the Actions list on the left of the Account form:

Re-Open Account

Clicking  Re-Open Account will reverse all transactions with the exception of the Bank Transaction that repaid the closing balance, and any Standard Transactions that were posted as part of the closing process. The Bank Transaction must be reversed like a normal dishonoured payment to allow for correct audit ability and re-scheduling future payments.

Re-Open Account will reverse all transactions with the exception of the Bank Transaction that repaid the closing balance, and any Standard Transactions that were posted as part of the closing process. The Bank Transaction must be reversed like a normal dishonoured payment to allow for correct audit ability and re-scheduling future payments.

Reverse the Payment Transaction using Bank Entry, Transaction Entry, or Account Withdrawal. This will set the current Account Balance back to where it was before the closure process began, and also create a new schedule of payments, with payments of the same value as previously.

Close Account

Click  Close Account to finalise the closure. This will remove the easy Re-Open Account facility and reset the Status to Closed.

Close Account to finalise the closure. This will remove the easy Re-Open Account facility and reset the Status to Closed.

Process to Final Closure

Once the Review date has been reached, a Task will appear in the relevant Manager's Task List. You can still choose to close the Account manually by clicking Close Account as above, or you can close the Account from the Task Manager. Select the Accounts you wish to Close and click on the  to complete closure of the selected Accounts.

to complete closure of the selected Accounts.