<< Previous | Next >>

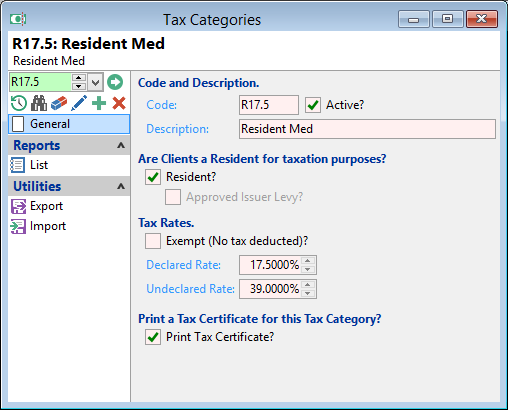

Code

Each Tax Category must have a unique code of up to 5 characters.

Description

A short and precise description of the Tax Category.

Exempt (no tax deducted)?

Tick if clients in this category are Exempt from paying tax.

Declared Rate

Enter the tax rate for a client of this category, where the tax number is supplied.

Undeclared Rate

Enter the tax rate applied for a client of this category, where the tax number is not supplied.

Print Tax Certificate?

Tick to Print a Certificate. To allow for better handling of Approved Issuer Levy (AIL) Deposits leave unticked. This means no Tax Certificate will be printed and the Deposit will not be included in an E-file.