Where the "Return" from invested deposits is distributed to "Deposits" rather than a set interest rate being paid, the Interest Distribution facility can be used. Investment income is divided according to the average daily balance of the deposits.

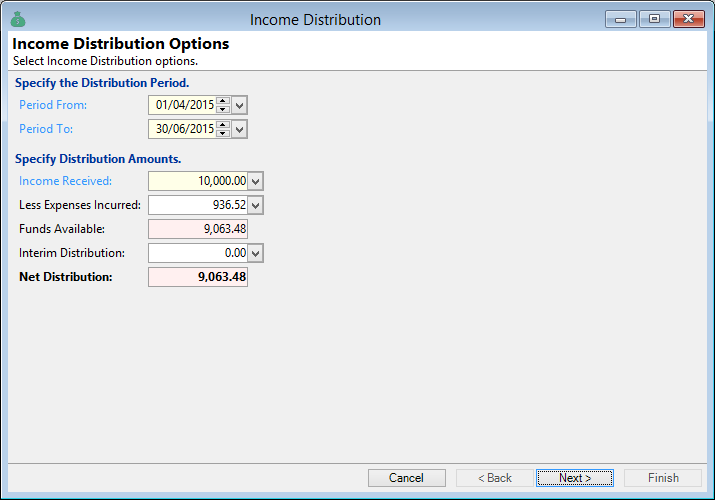

Period From

Enter the date to begin from.

Income Received

Enter the value that will distributed between the Deposit Accounts.

Less Expenses Incurred

Enter the value relating to any expenses incurred, which will be deducted from the Income Received value.

Funds Available

This will default the value that is available to be distributed to the Deposit Accounts.

Interim Distribution

Enter the value relating to any previous distribution processed. For example, a finance company would like to distribute the "Income Received" value to their "Deposit Account" holders on a quarterly basis. $10,000.00 is to be distributed for the tax year and one quarterly amount has already been distributed, therefore the amount of $2500.00 needs to be entered here.

Net Distribution

This defaults the net value that is available to be distributed to the Deposit Accounts.