Before using the finPOWER Connect General Ledger Export you must set up several options.

These link to the General Ledger by setting up a 'Chart of Accounts' that matches the Chart of Accounts within your Accounting Software, and then linking each element to the correct account.

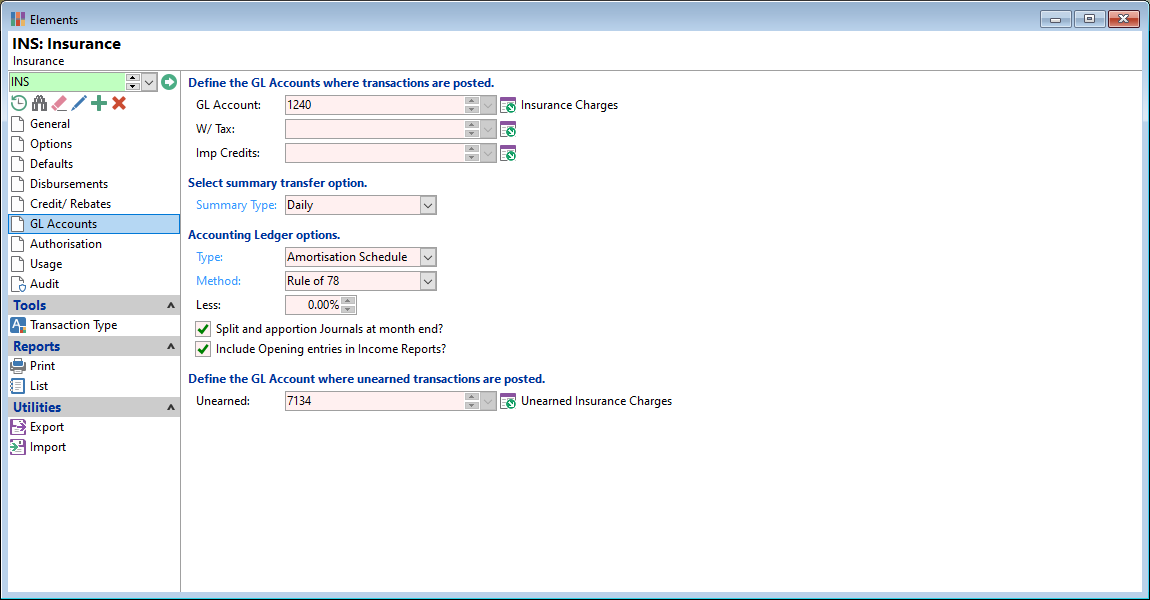

Define the GL Accounts where transactions are posted?

- GL Account - This is the link to the General Ledger; select the GL Account that the values for this element will be journaled to.

- W/Tax - If you are using Deposits and paying Withholding Tax, enter the corresponding GL code into this field.

- Imp Credits - This field is not currently used.

Select Summary transfer option

Select the appropriate Summary Type for the Element.

- EOM - Will summarise and total all journal transactions dated as at the End of Month.

- Daily - Will summarise and total all journal transactions dated on a daily basis.

- Full Detail - Will transfer full detail of all transactions.

If you find that the GL Export has a lot of transactions, you are best to review these settings. Changing from 'Full Detail' to 'EOM' will significantly change the number.

Type

Select the Type of Accounting Ledger transfer that is required from the list below:

| Type | Description |

|---|---|

| None | No Accounting Ledger is added therefore the element is earned immediately. |

| Amortisation Schedule | Creates General Ledger Journals to debit a GL Account and Amortise over the specified term. Journals must balance to zero. |

| Simple Journal | Allows a customised process to create General Ledger entries. These Journals do not need to balance to zero. |

Method

Select the type of Method that the Accounting Ledger will calculate and transfer, from the list below:

| Method | Description |

|---|---|

| On Date | Is earned on a specific date. |

| At Maturity | Is earned at the Accounts Maturity date. |

| At Close | Is earned when the Account is closed. |

| Proportional | Is earned evenly over the term. |

| Proportional Daily | Is calculated by dividing the number of days in the term time the number of days in the earned period. |

| Rule of 78 | Is calculated using the mathematical formula called the Rule of 78. Using the Rule of 78 means that more of the charges are earned at the beginning of the term than towards the end. |

| Contractual Interest | Accruals are calculated based on the Contractual Interest being charged over the life of the Account. For example if the Accounting Ledger Value is $100 and the total Interest charged to the Account is $1,000, each Accounting Ledger Accrual will be 1/10th of the corresponding Interest amount. Interest is charged on the reducing balance of the Account and therefore, higher at the beginning reducing over time, as will the Ledger Accruals. |

| Custom | This can be used in conjunction with a Script to amortise income. |

Less and additional checkboxes to select

- Less - The Basis is a rate of deduction used, to reduce the calculation by.

- Split and apportion Journals at Month End - The journal value will be proportioned daily at the end of the month. General ledger accruals will be dated end of month.

- Include Opening entries in Income Reports - Tick to include opening entries in Income Reports to contra the original transaction posted to the Account and amortise over the defined schedule.

Define the GL Account where unearned transactions are posted

Select from the dropdown list, the unearned GL Account that the values (for this element), will be journaled to.