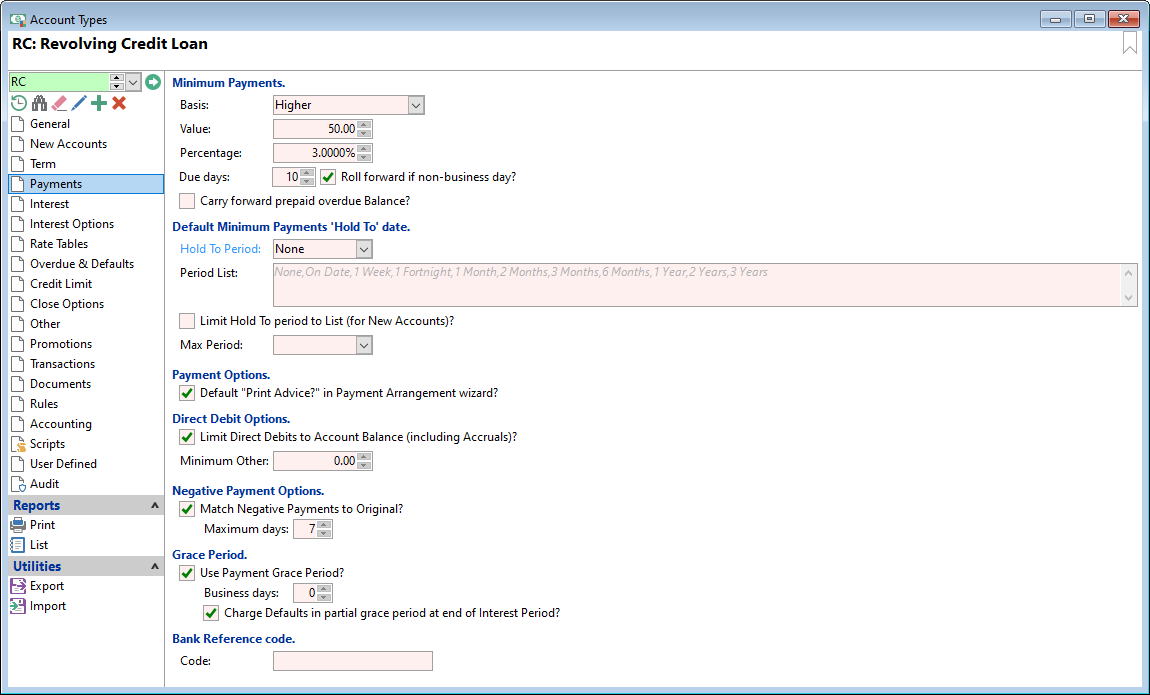

This page refers to the different fields available on the Payments Page of the Account Types Section of the Admin Libraries.

Minimum Payments

A minimum payment may be required. The options available to calculate the payment amount are as follows:

| Basis | Description |

|---|---|

| None | No payments will be due. |

| Set Value | Allows a payment to be calculated as a Set Dollar Value. |

| Percent of Balance | The payment due will calculate as a percent of the closing balance. |

| Higher | The payment will be the higher of Percent of Balance and Set Value. |

| Interest Only | The payment due will include the Interest charged in the period. |

| Interest and Fees Only | The payment due will include the Interest charged and any fees (not including Standard Transactions) charged in the period. |

| Instalment | Given that a maturity date is defined, a payment to pay off the loan as at the maturity date. |

| Ongoing Set Value | The payment due is a set amount and will keep on being made even if the Loan has a credit balance. |

| Custom | Works exactly like the "Higher" option, but has been added to allow modified calculations for specific finPOWER Connect users. |

Value

Where the payment due is a set amount, enter the default payment value.

Percentage

This option calculates the repayment as a percentage of the outstanding balance of the loan. Enter the percentage.

Due Days

The number of days after the Statement that the Minimum payment is due. Enter the number of days.

Move to next business date if non-business day?

Tick to move the payment due date to the next business day.

Carry forward prepaid overdue Balance?

Where there is a Prepaid balance on an Account, finPOWER Connect makes an adjustment to the schedule/payments/balance to remove the Prepaid status. Tick this option to leave the prepaid balance on the account without any adjustments being made to the Account.

Hold To Period

Can be set to stop minimum payments until the selected time period or date. Equivalent of deferred first payment.

Period List

Enter a comma separated list of first payment options available. Right click and Paste Hint to add to and amend the options shown in grey.

Limit Hold To period to List?

Tick the checkbox to limit the "Hold To" selection to the list defined above.

Limit Direct Debits to Account Balance (including Accruals)?

Tick to limit the Direct Debit to the Account Net Balance, regardless of remaining payment schedule items.

Minimum Other

Enter a minimum Direct Debit threshold amount. This prevents small ad-hoc charges, e.g. a $5.00 letter fee, from being Direct Debited immediately.

Instead, the Direct Debit is held until it exceeds the minimum threshold or there is a payment due.

Match Negative Payments to Original?

If ticked, finPOWER Connect will attempt to match a normal payment with a corresponding negative payment of the same value within the maximum number of days specified. The Payments are flagged as matching and treated like a "reversed" payment.

Maximum days

Specify the maximum number of days that a negative payment can be received within, to match to an "original" transaction.

Use Payment Grace Period?

By ticking the Grace Days, the system will look at any Overdue transactions allowing a number of days grace for a payment to be received and therefore will not charge Default Interest. If a payment is received within the grace period, the interest will be applied as if the payment was received on the due date.

For example, a payment was due Saturday and is received Monday instead, therefore the Interest is calculated as if payment was received on Saturday.

Business Days

This is number of days the system will "look back" from the day the payment was made to the due date, without incurring additional interest.

For example:

- if Business days equals 0, anything outside this range will incur additional interest, with the exception of Non-Business days.

- if Business days equals 1 (or more), then a payment within this range will not incur additional interest.

Charge Defaults in partial grace period at end of Interest Period?

Tick where Default Interest is to be charged when Grace Days span the Interest Charge Date and payment hasn't been made prior to the Interest posting.

If unticked, no Default Interest will be charged for the days between the payment due date and the end of the interest period, even if the payment has not been made.

Code

Enter a default bank reference for the Account Type; this might be for a particular product that you need to be able to keep track of.

Smart Tags can be used to refer back to the code; they are entered in the following two areas:

- Within Bank Accounts, Payment Methods, click on the drilldown button for the particular payment method, click next, and go down the page to the "Default Reference". From any of the dropdown lists select [ATCode] or [ARCode][AccId].

- Within an Account, select the Payments page and click on the "Edit" button for Payment Details, click next. Right mouse click within any of the "References" boxes, and select "ATCode (Account Type Bank Reference Code).