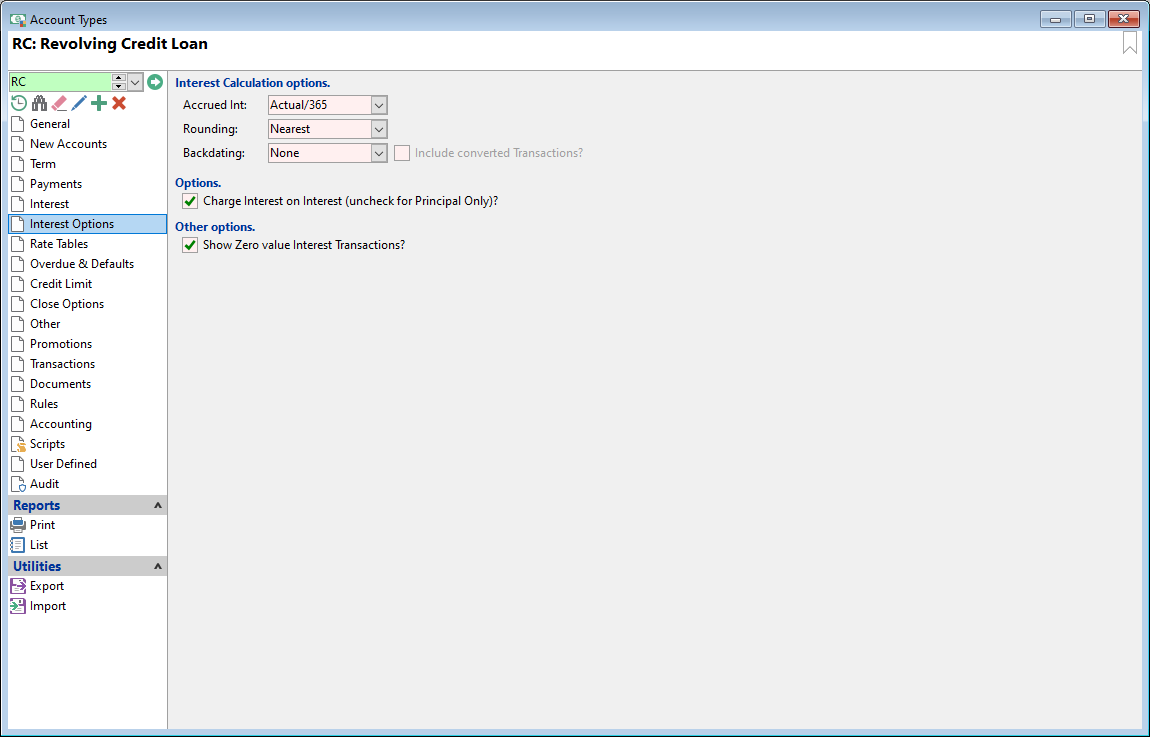

Accrued Int

| Method | Description |

|---|---|

| Actual/Actual | Daily balance * Interest Rate / number of actual days within the Calendar year |

| Actual/360 | Daily balance * Interest Rate / 360 * number of days |

| Actual/365 | Daily balance * Interest Rate / 365 * number of days |

| Annualised |

Daily balance * Interest Rate / number of actual days within the Calendar year then divided by 12. For example, if charging a whole month's interest, instead of taking the total of each day's daily interest an annualised value is calculated and then divided by 12. This means the same interest will be charged irrespective of the month having 30 or 31 days. Interest Cycle - Quarterly: Interest is calculated slightly different to weekly/monthly. Example: Opening Date: 05/08/2010, Loan Advance: $1,500.00, Term: 12 months, Payments: Monthly, Interest Rate 17%, Interest Cycle: Quarterly. On the interest audit for the end of October, the first period of interest (5 August to 4 September) is calculated as follows: $1500 x 17%/12/31 x 27 =$18.5081 & $1500 x 17%/12/30 x 4 =$2.8333. Total interest is $21.3414 = $18.5081 + $2.8333. |

Rounding

| Method | Description |

|---|---|

| Nearest | Select to round the Interest to the nearest currency value. |

| Down | Select to round the Interest down to the nearest currency value. |

| Up | Select to round the Interest up to the nearest currency value. |

Backdating

Optionally select to have the Automatic Processes facility reverse all Interest and related Fee transactions for the period starting when a backdated transaction was posted. It also resets the "Last Charged" date for Interest back to this date. Then Automatic Processes facility will then re-charge the Interest and Fees based on the new balances.

| Option | Description |

|---|---|

| None | Interest and Fees will not be re-calculated if a transaction is backdated past the Interest Charged To date. |

| Tracking Only | Interest and Fees will not be recalculated, but the date of the backdated transaction will be recorded so that you can report on Accounts which have had backdated transactions in this interest period. The Backdated Transaction record will be removed the next time Interest is charged, so it is important to perform any actions required before processing interest again. |

| Reverse | Interest and Fees will be re-calculated if a transaction is backdated past the Interest Charged To date. |

Is Interest charged on the outstanding Interest Balance(Principal Only)?

Define if interest is to be charged on any unpaid Interest.

Show Zero value Interest Transactions?

Tick to show/hide Zero value Interest Transactions. You should consider unticking this checkbox for Precomputed Interest Loans where Interest is charged upfront and for SACC Loans in Australia.