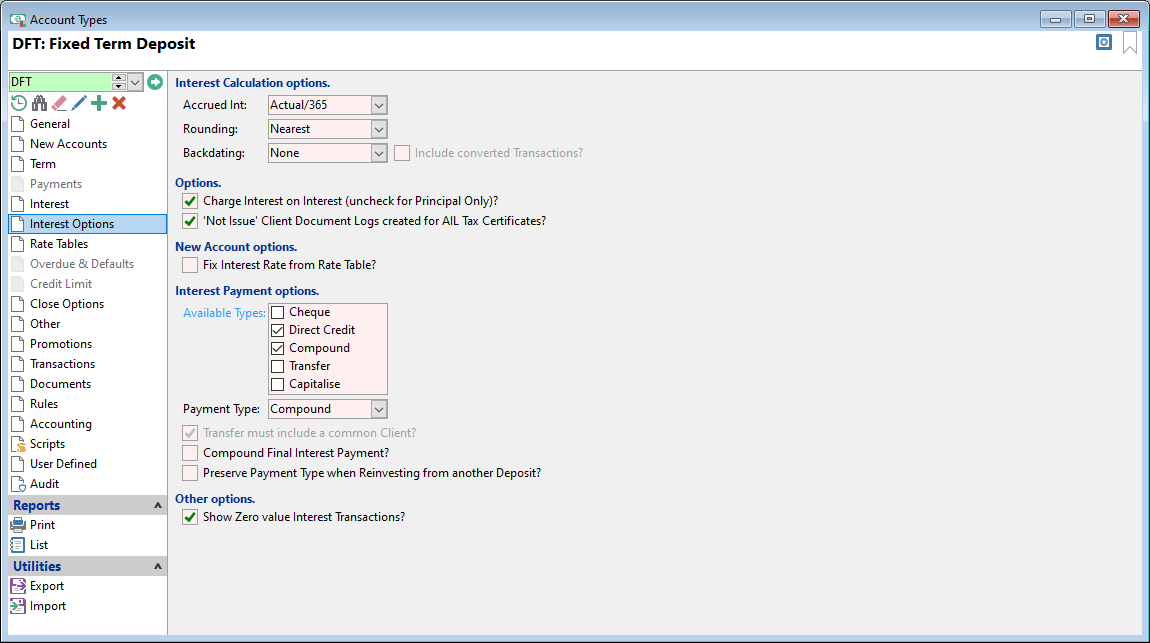

Accrued Int

| Method | Description |

|---|---|

| Actual/Actual | Daily balance * Interest Rate / number of actual days within the Calendar year |

| Actual/360 | Daily balance * Interest Rate / 360 * number of days |

| Actual/365 | Daily balance * Interest Rate / 365 * number of days |

| Annualised | Daily balance * Interest Rate / number of actual days within the Calendar year then divided by 12. For example, if charging a whole month's interest, instead of taking the total of each day's daily interest, an annualised value is calculated and then divided by 12. This means the same interest will be charged irrespective of the month having 30 or 31 days. |

Rounding

| Method | Description |

|---|---|

| Nearest | Select to round the Interest to the nearest currency value. |

| Down | Select to round the Interest down to the nearest currency value. |

| Up | Select to round the Interest up to the nearest currency value. |

Backdating

Optionally select to have the Automatic Processes facility reverse all Interest and related Fee transactions for the period starting when a backdated transaction was posted. It also resets the "Last Charged" date for Interest back to this date. Then Automatic Processes facility will then re-charge the Interest and Fees based on the new balances.

| Option | Description |

|---|---|

| None | Interest and Fees will not be re-calculated if a transaction is backdated past the Interest Charged To date. |

| Tracking Only | Interest and Fees will not be recalculated, but the date of the backdated transaction will be recorded so that you can report on Accounts which have had backdated transactions in this interest period. The Backdated Transaction record will be removed the next time Interest is charged, so it is important to perform any actions required before processing interest again. |

| Reverse | Interest and Fees will be re-calculated if a transaction is backdated past the Interest Charged To date. |

Include converted Transactions?

If Interest and Fees are being reversed and re-charged when transactions are backdated, check for transactions with an Element Type of 'Interest' and a Source of 'Converted' to also be reversed and re-charged.

Charge Interest on Interest (untick for Principal Only)?

Tick if interest is to be earned on any compounded Interest.

Unchecked will only accrue and earn interest on the principal balance.

Available Types

Define which interest payment types are applicable.

| Cheque | Tick to allow the interest payment on a deposit to be paid by Cheque. This will display in the Pay Type dropdown list of the new account wizard. |

| Direct Credit | Tick to allow the interest payment on a deposit to be paid by Direct Credit. This will display in the Pay Type dropdown list of the new account wizard. |

| Compound | Tick to allow the interest payment to be added to the principal of the deposit. This will display in the Pay Type dropdown list of the new account wizard. |

| Transfer | Tick to allow the interest payment on a deposit to be transferred to another loan or deposit. This will display in the Pay Type dropdown list of the new account wizard. |

Payment Type

Select the Pay Type you would like to display on the new account wizard.

Transfer must include a common Client?

If ticked the Deposit interest payment must be transferred to another Account with a common Client.